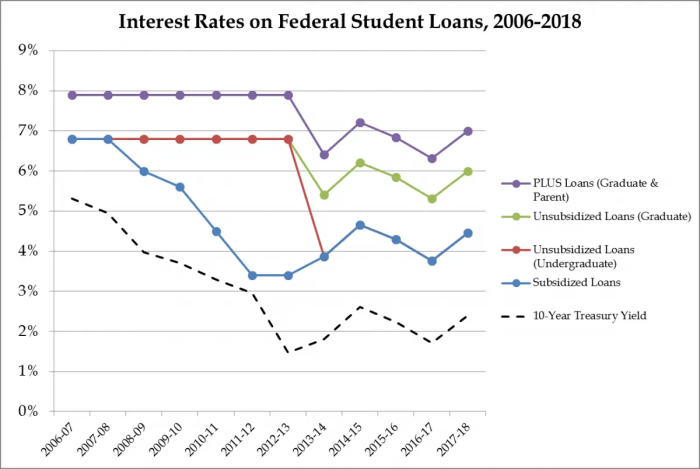

The burden of student loan debt weighs heavily on millions, impacting financial futures and economic growth. Lowering interest rates on student loans presents a potential solution, offering immediate relief to borrowers and stimulating the economy. This exploration delves into the multifaceted implications of such a policy, examining its economic effects, government actions, and impact on borrowers, alongside alternative approaches to tackling the student loan crisis. This analysis considers the potential benefits and drawbacks for various borrower groups, including undergraduates and graduates, while also assessing the feasibility and long-term sustainability of interest rate reductions from both governmental and private sector perspectives. Read More …