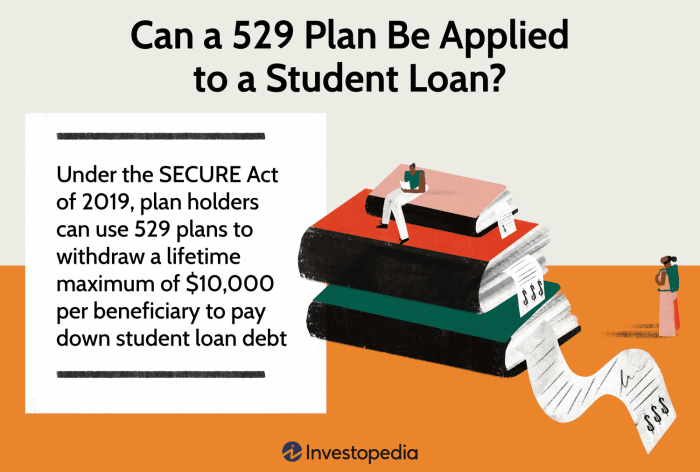

The soaring cost of higher education leaves many graduates grappling with substantial student loan debt. Simultaneously, families diligently save for their children’s college education using 529 plans, powerful tax-advantaged savings vehicles. This naturally leads to a crucial question: can these funds, intended for tuition and related expenses, be used to alleviate the burden of student loan repayment? The answer, as we will explore, is nuanced, depending on various factors and interpretations of IRS regulations. This guide delves into the intricacies of 529 plans and their permissible uses, specifically addressing the possibility of applying these funds towards student loan debt. We Read More …