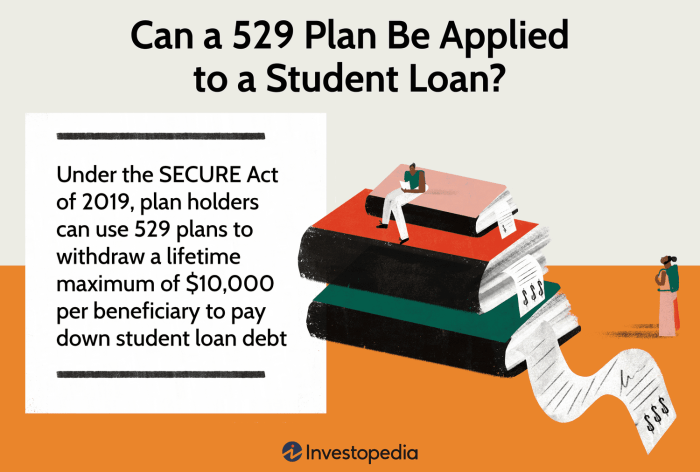

Securing the best rates for private student loans is crucial for navigating the complexities of higher education financing. Understanding the factors that influence interest rates, from credit scores to loan amounts and repayment terms, empowers students to make informed decisions. This guide explores strategies for obtaining favorable rates, including improving creditworthiness, exploring refinancing options, and effectively comparing loan offers from various lenders. We’ll also delve into hidden fees, responsible borrowing practices, and alternative funding sources to ensure a comprehensive understanding of the financial landscape. The journey to affordable higher education often begins with a thorough understanding of private student loan Read More …