Navigating the world of student loans can feel overwhelming, especially when considering the diverse options available through banks. This guide provides a clear and concise overview of bank student loan options, helping you understand the various types of loans, eligibility requirements, repayment plans, and potential pitfalls to avoid. We’ll explore both the advantages and disadvantages of borrowing from banks, empowering you to make informed decisions about financing your education. From understanding the differences between federal and private loans to mastering the intricacies of interest rates and repayment schedules, we aim to demystify the process. We’ll also address crucial aspects such Read More …

Tag: education funding

Best Private Student Loans A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when considering private options. This guide offers a clear and concise overview of best private student loans, exploring various lenders, interest rates, repayment plans, and crucial factors to consider before committing to a loan. We’ll delve into the differences between federal and private loans, highlighting the advantages and disadvantages of each to help you make an informed decision. Understanding the intricacies of private student loans is key to securing the best financial outcome for your education. This guide aims to equip you with the knowledge necessary to compare loan offers Read More …

Best Parent Student Loans A Comprehensive Guide

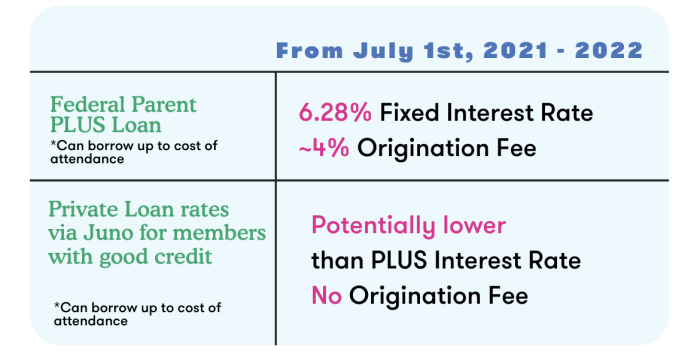

Navigating the world of student loans can be daunting, especially for parents eager to support their children’s higher education. This guide offers a comprehensive overview of the best parent student loan options, exploring federal and private loans, eligibility requirements, repayment strategies, and alternative financing methods. We’ll delve into the intricacies of interest rates, fees, and repayment plans, empowering you to make informed decisions that align with your family’s financial goals. Understanding the differences between federal and private loans is crucial. Federal loans often offer more borrower protections, while private loans may have varying interest rates and eligibility criteria. This guide Read More …

K-12 Student Loans A Growing Concern

Navigating the complexities of K-12 education often involves significant financial burdens for families. While traditionally associated with higher education, the increasing reliance on loans for secondary schooling is a burgeoning issue demanding attention. This exploration delves into the prevalence, causes, and consequences of K-12 student loans, examining their impact on families and exploring potential solutions. This analysis will cover the various types of loans available, the demographics most affected, and the contributing factors driving this trend. We will also investigate alternative funding sources, discuss necessary policy reforms, and highlight the crucial role educational institutions play in supporting students and families Read More …

Navigating Parent Loans for Students: A Comprehensive Guide

The soaring cost of higher education often leaves families grappling with the question of how to finance their children’s college dreams. Parent loans for students represent a significant financial commitment, impacting family budgets and long-term financial well-being. Understanding the various types of loans available, their associated risks, and the alternative financing options is crucial for making informed decisions that align with your family’s financial goals. This guide aims to provide a clear and comprehensive overview of the parent loan landscape, empowering you to navigate this process effectively. From exploring federal and private loan options to understanding repayment plans and potential Read More …

International Student Loans No Cosigner

Securing higher education funding as an international student can be a daunting task. The traditional route often involves finding a cosigner, a financially responsible individual willing to guarantee your loan repayment. However, this isn’t always feasible. This guide explores the landscape of international student loans available without a cosigner, detailing the eligibility criteria, available loan amounts and interest rates, repayment options, and the overall application process. We’ll also delve into alternative funding avenues and strategies for navigating the potential challenges. Navigating the complexities of international student finance requires careful planning and a thorough understanding of the available options. Understanding the Read More …

Navigating the Landscape of Non-Certified Student Loans

Securing funding for higher education is a significant undertaking, and the options extend beyond the well-trodden path of federally certified student loans. Non-certified student loans, offered by private lenders, present a distinct avenue for financing education, but with a landscape of varying terms, risks, and rewards. Understanding the nuances of these loans is crucial for making informed financial decisions. This exploration delves into the intricacies of non-certified student loans, examining their characteristics, eligibility requirements, and potential pitfalls. We will compare them to certified loans and other financing alternatives, equipping you with the knowledge to navigate this complex financial terrain confidently. Read More …

Federal Student Aid Parent PLUS Loan Guide

Navigating the complexities of financing a child’s higher education can be daunting. The Federal Student Aid Parent PLUS Loan offers a potential solution, allowing parents to borrow funds to cover their child’s educational expenses. However, understanding the loan’s terms, conditions, and potential long-term financial implications is crucial before committing. This guide provides a comprehensive overview of Parent PLUS loans, addressing key aspects such as eligibility, interest rates, repayment options, and potential risks. This in-depth exploration will equip parents with the necessary knowledge to make informed decisions regarding Parent PLUS loans. We’ll examine the application process, explore various repayment strategies, and Read More …

Can You Use a 529 to Pay Off Student Loans? A Comprehensive Guide

Navigating the complexities of higher education financing often leaves students and families grappling with significant student loan debt. While 529 plans are widely known for their role in funding college tuition, many wonder if these savings vehicles can also be utilized to alleviate the burden of student loan repayments. This guide delves into the intricacies of using a 529 plan for student loan payoff, exploring the legal parameters, financial implications, and practical considerations to help you make an informed decision. We will examine the IRS regulations governing 529 plan withdrawals, compare the potential benefits of using 529 funds against alternative Read More …

Navigating the Complexities of Uncertified Student Loans

The pursuit of higher education often necessitates financial assistance, leading many students to explore various loan options. While federally backed student loans offer a degree of protection and standardized terms, a significant portion of student borrowing comes from less regulated sources – uncertified student loans. These loans, often originating from private lenders or even personal arrangements, present a unique landscape of risks and opportunities that require careful consideration. Understanding the nuances of uncertified student loans is crucial for prospective borrowers. This exploration will delve into the legal definitions, inherent risks, available sources, and viable alternatives, equipping students with the knowledge Read More …