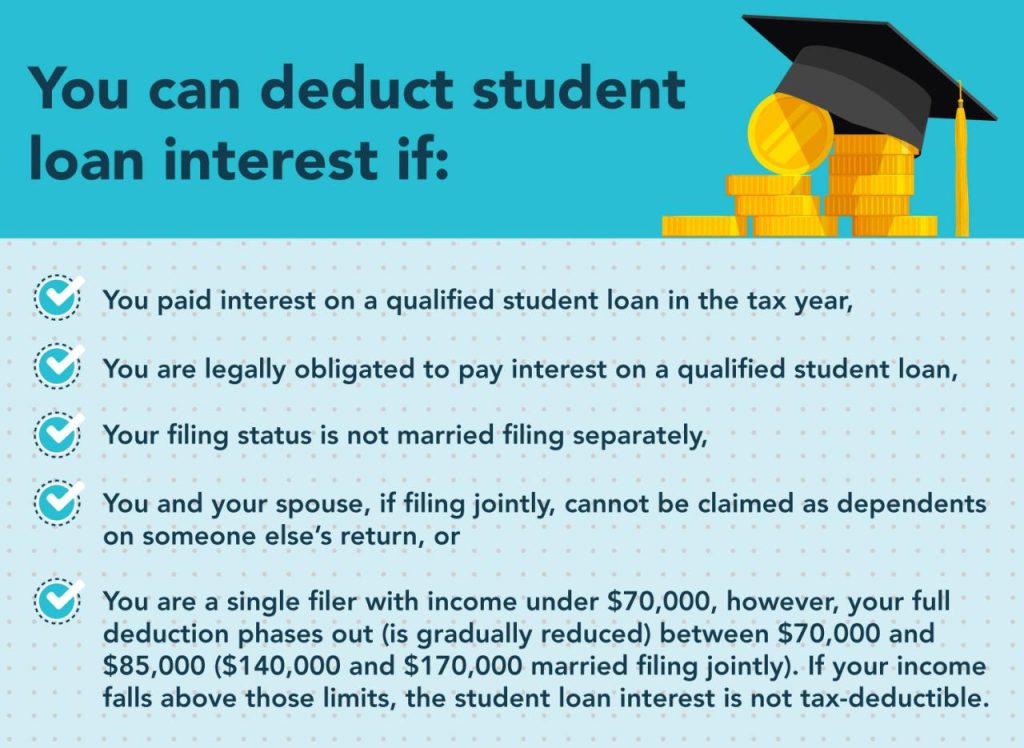

Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits can significantly ease the burden. The student loan interest tax credit offers a valuable opportunity to reduce your tax liability and ultimately, the total cost of your education. This guide provides a comprehensive overview of eligibility requirements, calculation methods, and claiming procedures, empowering you to make informed decisions about maximizing this valuable credit. This credit isn’t a one-size-fits-all solution; eligibility hinges on factors like your modified adjusted gross income (MAGI) and the type of student loan you hold. We’ll explore these nuances, providing clear examples Read More …