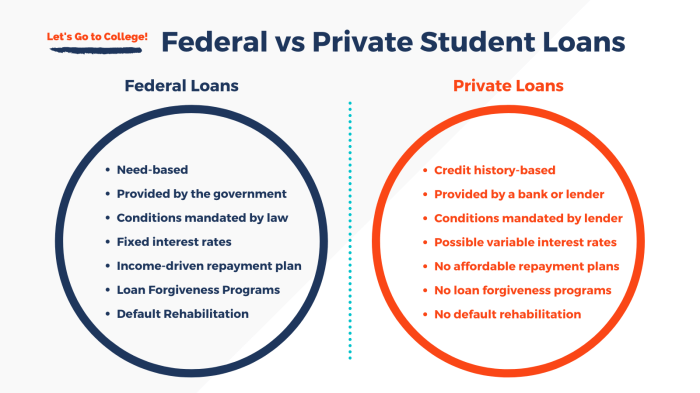

Pursuing a graduate degree is a significant investment in your future, often requiring substantial financial resources. Understanding the landscape of federal student loans is crucial for making informed decisions and ensuring a smooth path towards your academic goals. This guide provides a detailed overview of federal loan options available to graduate students, outlining eligibility requirements, application processes, repayment strategies, and potential challenges. We aim to empower you with the knowledge necessary to navigate the complexities of financing your graduate education effectively. From exploring the nuances of Direct Unsubsidized and Direct PLUS loans to understanding loan forgiveness programs and developing sound Read More …