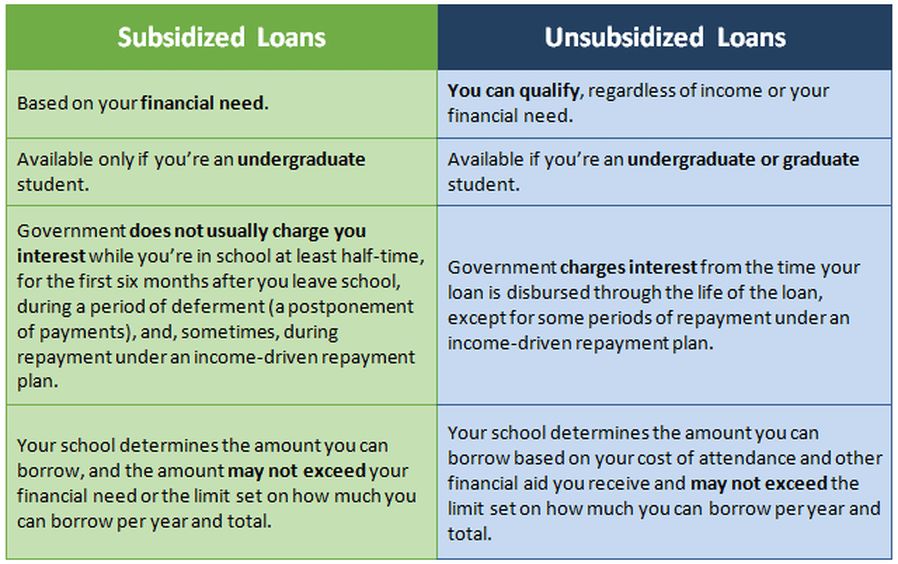

Navigating the world of student loans can feel like traversing a complex maze. Two key players in this financial landscape are subsidized and unsubsidized federal student loans. While both offer financial assistance for higher education, understanding their core differences is crucial for making informed decisions that impact your financial future. This guide delves into the nuances of each loan type, providing a clear comparison to empower you with the knowledge needed to choose wisely. From interest accrual and eligibility requirements to repayment options and the potential impact on your credit score, we’ll explore every facet of subsidized versus unsubsidized loans. Read More …