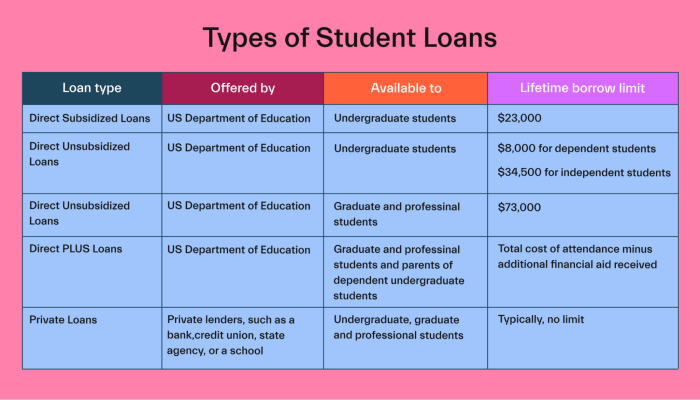

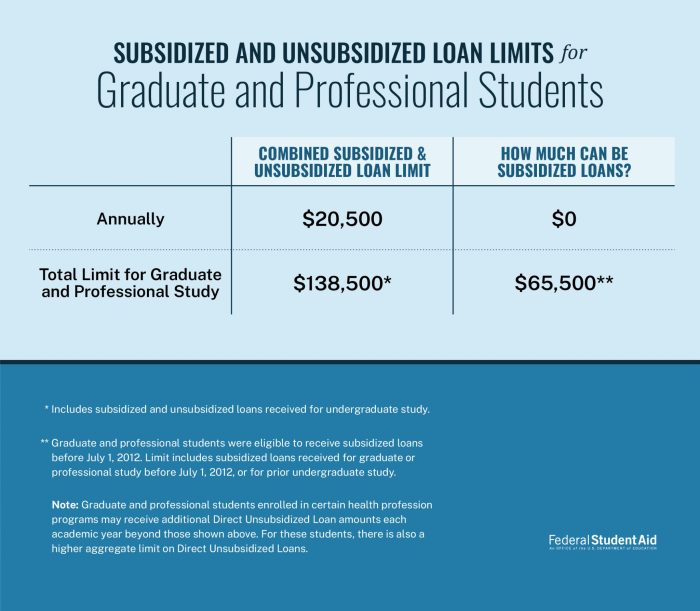

Navigating the world of student loans can feel overwhelming, especially when faced with the seemingly similar yet distinctly different options of subsidized and unsubsidized federal loans. Understanding the nuances between these loan types is crucial for responsible borrowing and minimizing long-term financial burdens. This exploration will illuminate the key distinctions, empowering you to make informed decisions about your educational funding. This guide will delve into the core differences between subsidized and unsubsidized federal student loans, examining interest rates, eligibility requirements, repayment options, credit impact, and the role of government subsidies. Through clear explanations and practical examples, we aim to provide Read More …