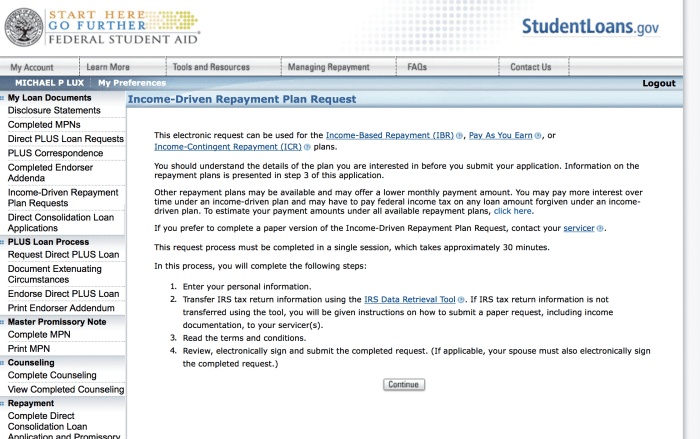

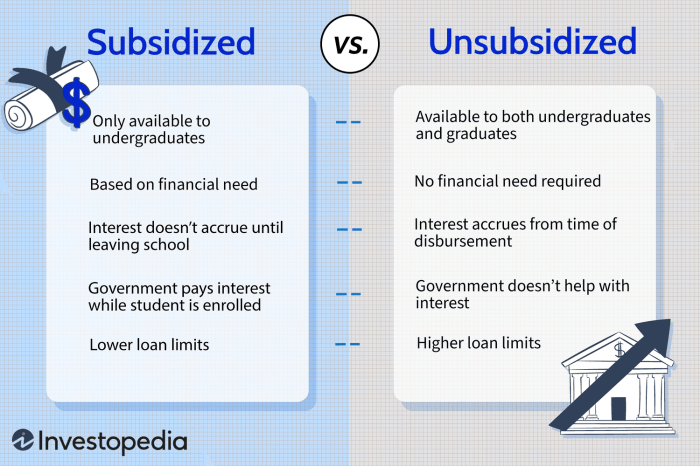

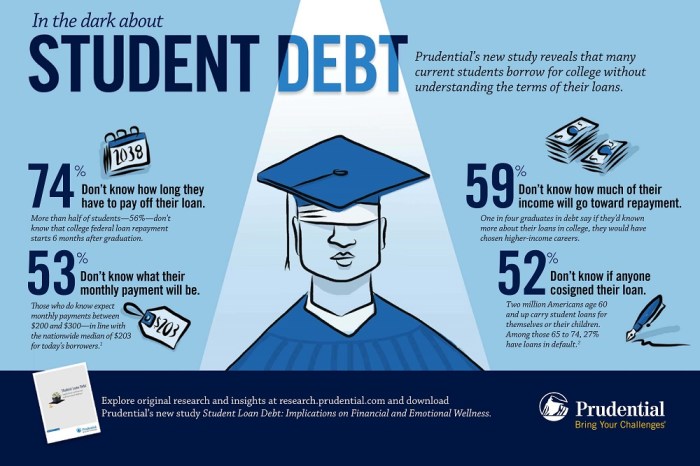

Navigating the complexities of higher education often involves the crucial step of securing funding. Tuition loans for students represent a significant financial commitment, impacting not only immediate expenses but also long-term financial well-being. Understanding the various types of loans available, their associated costs, and the implications of repayment is paramount for students and their families. This guide aims to demystify the process, providing a clear and concise overview of tuition loans, empowering you to make informed decisions about your educational financing. From federal student loans, with their subsidized and unsubsidized options, to the intricacies of private loans and their varying Read More …