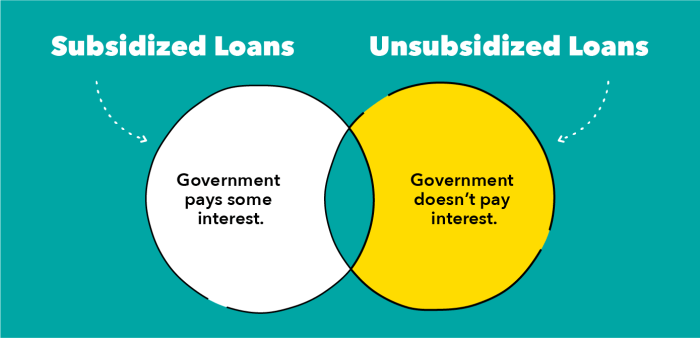

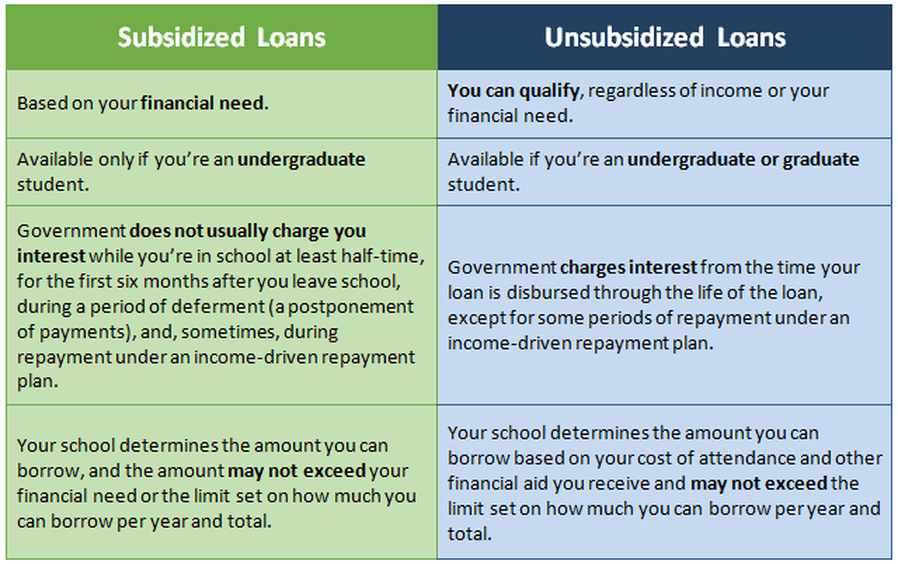

Navigating the world of student loans can feel overwhelming, especially when faced with terms like “subsidized” and “unsubsidized.” These seemingly minor distinctions can significantly impact your borrowing experience, from interest rates and eligibility to repayment options and long-term financial health. Understanding these differences is crucial for making informed decisions about financing your education and avoiding potential pitfalls down the road. This guide will dissect the key differences between subsidized and unsubsidized federal student loans, providing clarity and empowering you to make the best choices for your future. This detailed comparison will cover interest rates, eligibility requirements, loan forgiveness programs, repayment Read More …