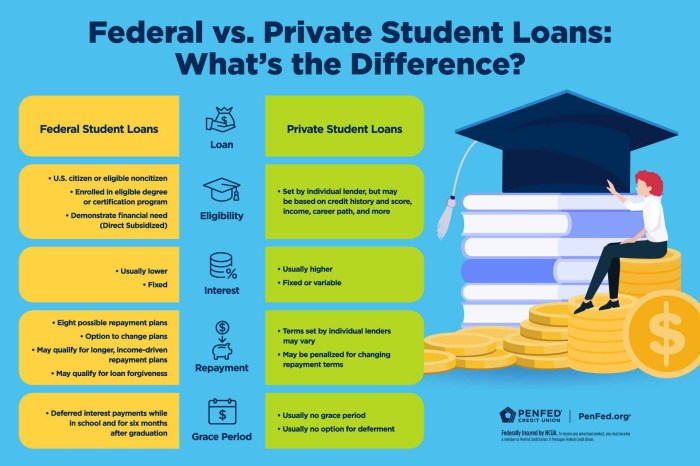

Navigating the complexities of student loan repayment can feel overwhelming, especially during unexpected financial hardship. Understanding your options for deferment is crucial to preventing a snowball effect of debt and potential negative impacts on your credit. This guide provides a clear path through the process of applying for a student loan hardship deferral, outlining eligibility criteria, application procedures, and the long-term financial implications. We’ll also explore alternative repayment plans and resources available to help you manage your student loan debt effectively. This comprehensive resource aims to demystify the often-confusing world of student loan deferment, empowering you to make informed decisions Read More …