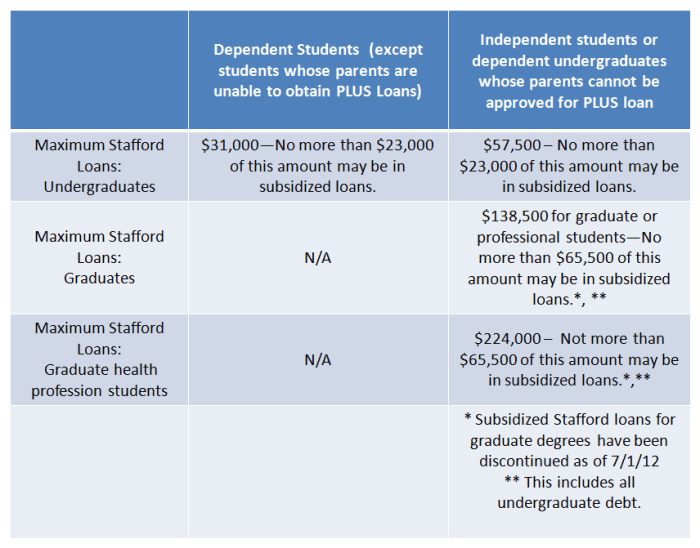

Navigating the complexities of graduate school often involves understanding the financial landscape. A crucial element of this is grasping the aggregate limit for graduate student loans – the maximum amount you can borrow across all federal and private loan programs. This limit significantly impacts your borrowing capacity and long-term financial well-being, necessitating careful planning and understanding of the factors that influence it. This guide explores the intricacies of aggregate loan limits, examining the components of the calculation, factors affecting eligibility, strategies for responsible borrowing, and the consequences of exceeding the limit. We’ll delve into government regulations, offer practical budgeting tips, Read More …