Securing funding for higher education is a crucial step for many students. Navigating the process of applying for a private student loan online can feel overwhelming, but understanding the key aspects simplifies the journey. This guide provides a comprehensive overview of the online application process, from understanding eligibility requirements to managing your loan post-graduation. We’ll explore the various types of private student loans available, compare different lenders, and delve into the financial implications of borrowing. We’ll also address common pitfalls to avoid and offer strategies for minimizing risks and maximizing the benefits of private student loans. By the end, you’ll Read More …

Tag: higher education funding

Navigating Private Loans for Student Success: A Comprehensive Guide

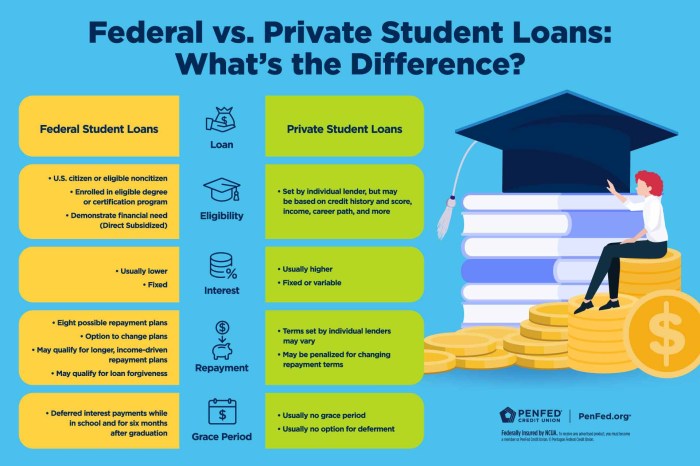

The pursuit of higher education often involves navigating the complex landscape of student financing. While federal student loans provide a crucial foundation, many students find themselves needing supplemental funding. This is where private student loans enter the picture, offering a potential solution but also presenting a set of unique considerations. Understanding the intricacies of private student loans – from eligibility requirements and interest rates to repayment options and potential risks – is crucial for making informed financial decisions. This guide aims to demystify the process of securing and managing private student loans. We’ll explore the various types of loans available, Read More …

Navigating the Landscape of Pre-Approved Student Loans

Securing higher education often involves navigating the complex world of student financing. Pre-approved student loans offer a streamlined approach, allowing prospective students to understand their borrowing potential before even applying to colleges. This process, while seemingly advantageous, requires careful consideration of various factors, including interest rates, repayment terms, and eligibility criteria. Understanding the nuances of pre-approved loans empowers students to make informed decisions and avoid potential pitfalls. This comprehensive guide explores the benefits and drawbacks of pre-approved student loans, providing a detailed overview of the application process, different loan types, and crucial considerations for effective debt management. We aim to Read More …

A private student loan is a loan that helps fund higher education.

Navigating the complexities of higher education often involves the crucial decision of securing funding. Private student loans represent a significant avenue for financing college, but understanding their intricacies is paramount. This guide delves into the essential aspects of private student loans, from eligibility and application processes to repayment strategies and potential risks. We aim to equip you with the knowledge to make informed decisions about this significant financial commitment. This exploration will cover key differences between private and federal loans, examining interest rates, fees, and repayment options. We’ll also discuss alternative funding sources and strategies for minimizing debt, ensuring you’re Read More …

Navigating Pinnacle Bank Student Loans: A Comprehensive Guide

Securing funding for higher education is a significant step, and understanding your loan options is crucial. This guide delves into the world of Pinnacle Bank student loans, providing a detailed overview of their various products, application processes, repayment options, and associated costs. We’ll also compare Pinnacle Bank’s offerings to those of other lenders, helping you make an informed decision about financing your education. From understanding eligibility requirements and navigating the application process to exploring repayment plans and managing potential risks, we aim to equip you with the knowledge needed to confidently pursue your educational goals with Pinnacle Bank’s student loan Read More …

ICICI Bank Student Loan A Comprehensive Guide

Securing higher education funding can be a significant hurdle, but ICICI Bank offers student loans designed to ease the financial burden. This guide navigates the intricacies of the ICICI Bank student loan process, providing a clear understanding of eligibility, interest rates, repayment options, and the application procedure. We’ll explore the advantages and disadvantages to help you make an informed decision. From understanding eligibility criteria for undergraduate and postgraduate studies to mastering the application process and navigating repayment schedules, we aim to demystify the entire student loan journey with ICICI Bank. We’ll also compare ICICI Bank’s offerings to other major lenders, Read More …

Navigating the Path to Higher Education: A Comprehensive Guide to On-Ramp Student Loans

The rising cost of higher education presents a significant hurdle for many aspiring students. Traditional student loan models often feel overwhelming, leaving prospective learners grappling with complex terms and potentially crippling debt. Enter on-ramp student loans, a relatively new approach designed to ease the financial burden and provide a more accessible pathway to higher learning. This guide delves into the intricacies of on-ramp student loans, exploring their benefits, drawbacks, and practical implications for students navigating the complex landscape of financing their education. On-ramp student loans differ significantly from traditional loans in their structure and approach to repayment. They typically offer Read More …

Navigating the IA Student Loan Landscape: A Comprehensive Guide

Securing higher education often involves navigating the complex world of student loans. In Iowa, understanding the available IA student loan options is crucial for prospective and current students. This guide delves into the intricacies of IA student loans, providing a clear path through eligibility requirements, application processes, repayment plans, and potential pitfalls. We aim to empower you with the knowledge necessary to make informed decisions about your educational financing. From exploring the different types of IA student loans and their associated interest rates to understanding the consequences of default, this resource serves as a one-stop shop for all your IA Read More …

How to Get a Student Loan from a Bank: A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when dealing with the complexities of securing funding from a bank. This guide provides a clear and concise path to understanding the process, from eligibility requirements and loan types to interest rates and repayment strategies. We’ll demystify the application process, equip you with the knowledge to avoid predatory lending, and empower you to make informed financial decisions for your education. Securing a student loan is a significant step towards achieving your educational goals. Understanding the various options available, the associated costs, and the potential pitfalls is crucial for responsible borrowing. Read More …

GA Student Loans A Comprehensive Guide

Navigating the complexities of higher education financing can be daunting, particularly when understanding the nuances of state-specific student loan programs. This guide delves into the intricacies of Georgia student loans, providing a clear and concise overview of available options, repayment strategies, and potential pitfalls. We’ll explore the various types of loans, eligibility requirements, and interest rates to help you make informed decisions about your financial future. From understanding the application process to managing repayment plans and addressing potential defaults, this resource aims to equip you with the knowledge necessary to effectively manage your Georgia student loan debt. We’ll also examine Read More …