Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with substantial debt. Income-Driven Repayment (IDR) plans offer a lifeline, tailoring monthly payments to your income. These plans, while not a magic bullet, provide a crucial pathway towards manageable debt and, in some cases, potential loan forgiveness. Understanding the nuances of each IDR plan—like ICR, PAYE, REPAYE, and IBR—is key to making informed decisions about your financial future. This guide will demystify IDR plans, exploring eligibility requirements, payment calculations, long-term implications, and the application process. We’ll compare different plan types, helping you choose the best fit for Read More …

Tag: IDR plans

Programs to Pay Off Student Loans

Navigating the complex landscape of student loan repayment can feel overwhelming, but understanding the available options is the first step towards financial freedom. This guide explores various government programs, loan consolidation strategies, forgiveness opportunities, and private lender options, providing a comprehensive overview to help you strategize your repayment journey. From Income-Driven Repayment (IDR) plans tailored to your income to loan forgiveness programs for specific professions, numerous avenues exist to manage and potentially reduce your student loan debt. We’ll delve into the nuances of each program, highlighting their eligibility criteria, benefits, and potential drawbacks, empowering you to make informed decisions about Read More …

Federal Student Loans Forgiven After 10 Years

Navigating the complexities of federal student loan repayment can feel overwhelming. Many borrowers are unaware of the potential for loan forgiveness after a decade of payments under Income-Driven Repayment (IDR) plans. This program offers a lifeline to those struggling with substantial student debt, but understanding its intricacies is crucial for successful participation. This guide will clarify the requirements, potential benefits, and challenges associated with achieving federal student loan forgiveness after 10 years. This exploration will delve into the various IDR plans, providing a clear picture of how they impact the forgiveness timeline and the ultimate remaining loan balance. We will Read More …

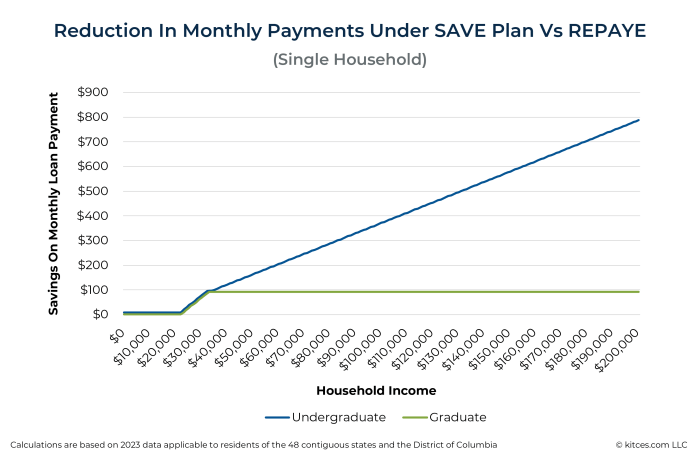

Student Loan Save Plan Update Key Changes

Navigating the complexities of student loan repayment can feel overwhelming, especially with the frequent changes to available plans. This update provides a clear overview of recent modifications to student loan save plans, including Income-Driven Repayment (IDR) and Public Service Loan Forgiveness (PSLF) programs. We’ll explore how these changes impact borrowers with different income levels and loan amounts, offering practical advice to help you make informed decisions about your repayment strategy. Understanding these adjustments is crucial for borrowers to optimize their repayment journey and potentially save significant amounts of money over the life of their loans. This guide aims to demystify Read More …

Student Loan Income Driven Repayment Plans

Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Driven Repayment (IDR) plans is a crucial step towards financial freedom. IDR plans offer a lifeline to borrowers struggling with high monthly payments by basing repayments on a percentage of their discretionary income. This approach allows for more manageable monthly payments, potentially leading to loan forgiveness after a set period. This guide explores the intricacies of IDR plans, providing clarity on eligibility, calculations, long-term implications, and how to navigate changes in your financial circumstances. From understanding the various IDR plan options and their eligibility criteria to calculating your Read More …

Student Loan Changes 2024 A Comprehensive Overview

The landscape of student loan repayment is shifting in 2024, presenting both challenges and opportunities for borrowers. Proposed changes to repayment plans, loan forgiveness programs, and interest rates promise significant alterations to the student loan experience. Understanding these changes is crucial for navigating the complexities of repayment and maximizing financial well-being. This overview delves into the specifics of these modifications, examining their potential impact on various borrower demographics and offering insights into the long-term implications. We will analyze the proposed alterations to income-driven repayment (IDR) plans, explore adjustments to loan forgiveness programs, and assess the projected effects on interest rates Read More …

Secure 2.0 Student Loans A Comprehensive Guide

The SECURE 2.0 Act has significantly altered the landscape of student loan repayment, introducing sweeping changes that impact millions of borrowers. This guide delves into the key provisions of Secure 2.0, examining its effects on various student loan types, income-driven repayment (IDR) plans, and loan forgiveness programs. We’ll explore both the potential benefits and challenges these changes present for borrowers, offering a clear understanding of navigating this new era of student loan management. From modifications to IDR plans and their impact on monthly payments and forgiveness timelines, to the altered eligibility criteria for loan forgiveness programs, we will dissect the Read More …

Recertify Income Student Loans A Guide

Navigating the complexities of income-driven repayment (IDR) plans for student loans can feel overwhelming. Understanding the recertification process, however, is crucial for borrowers seeking to manage their debt effectively and potentially qualify for loan forgiveness. This guide provides a comprehensive overview of recertifying income for student loans, covering everything from the different IDR plans available to the potential tax implications of loan forgiveness. We’ll explore the recertification process in detail, outlining the necessary documentation, timelines, and potential consequences of missed deadlines. We’ll also examine how changes in income affect monthly payments and provide examples to illustrate the impact. Furthermore, this Read More …

Income Driven Student Loan Repayment Plans

Navigating the complexities of student loan repayment can feel overwhelming, especially with the various repayment plans available. Income-driven repayment (IDR) plans offer a potential lifeline for borrowers struggling to manage their debt, tailoring monthly payments to their income. Understanding the nuances of these plans—from eligibility requirements and payment calculations to forgiveness options and long-term implications—is crucial for making informed financial decisions. This guide provides a comprehensive overview of income-driven student loan repayment, covering eligibility criteria for different IDR plans (ICR, PAYE, REPAYE, IBR), methods for calculating monthly payments, potential for loan forgiveness, and a comparison with standard repayment plans. We’ll Read More …

How to Calculate Discretionary Income for Student Loans

Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding how discretionary income is calculated. This crucial figure determines your monthly payment under income-driven repayment (IDR) plans, significantly impacting your financial well-being for years to come. Understanding the nuances of this calculation empowers you to make informed decisions about your repayment strategy and potentially lower your monthly burden. This guide provides a clear and comprehensive explanation of how discretionary income is calculated for student loans. We’ll explore the definitions of gross income versus discretionary income, detail allowable deductions, examine different IDR plans and their calculation methods, and Read More …