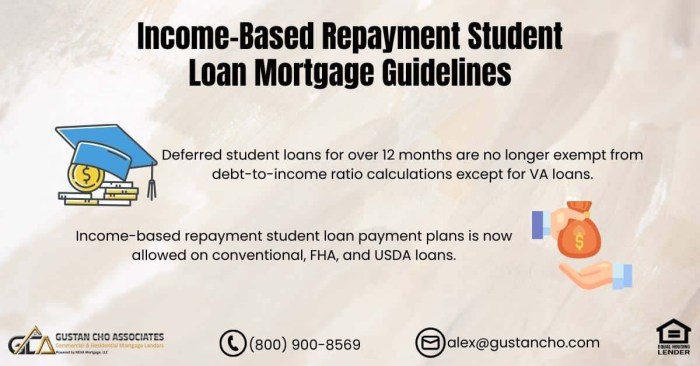

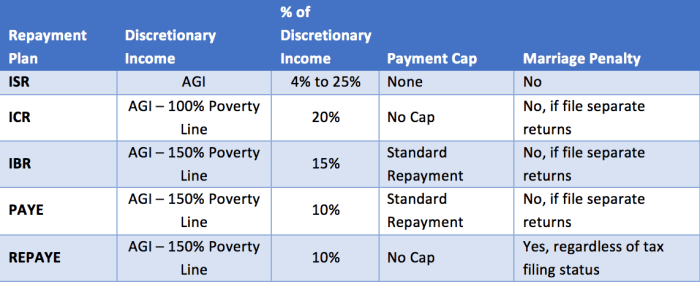

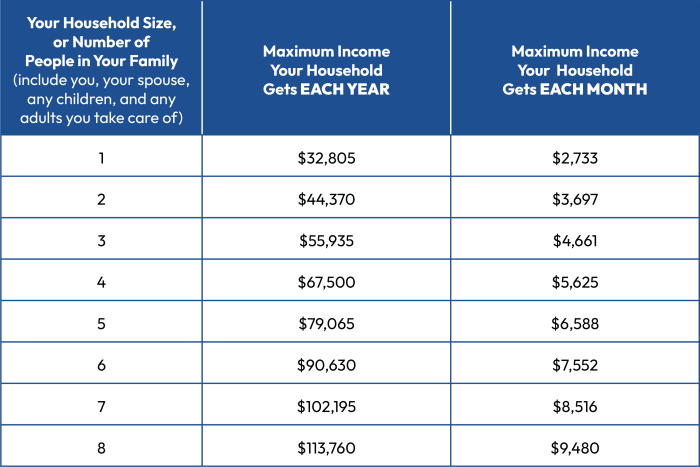

Navigating the complexities of student loan repayment can feel overwhelming, especially with the various repayment plans available. Income-based repayment (IBR) offers a potential solution, tailoring monthly payments to your income. Understanding the nuances of IBR, however, requires careful consideration of eligibility criteria, calculation methods, and long-term implications. This exploration will delve into the intricacies of IBR plans, providing a comprehensive overview to empower informed decision-making. This guide will cover the different types of IBR plans, such as IBR, PAYE, and REPAYE, outlining their eligibility requirements and how monthly payments are calculated. We’ll also examine the long-term effects of IBR, including Read More …