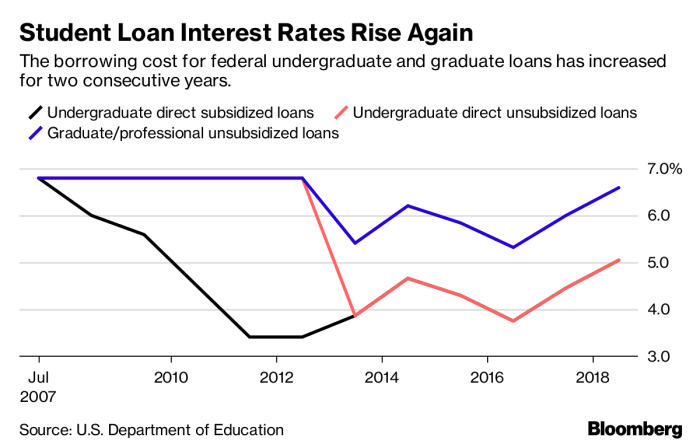

Navigating the complexities of higher education often involves the significant financial commitment of student loans. Understanding the historical trajectory of student loan interest rates is crucial for both current and prospective borrowers. This exploration delves into the evolution of these rates, examining key periods of fluctuation and the economic factors that have shaped them. We’ll uncover how these shifts have impacted borrowers and explore potential future trends. From the initial establishment of federal student loan programs to the present day, interest rates have experienced periods of both stability and dramatic change. These fluctuations are intricately linked to broader economic conditions, Read More …