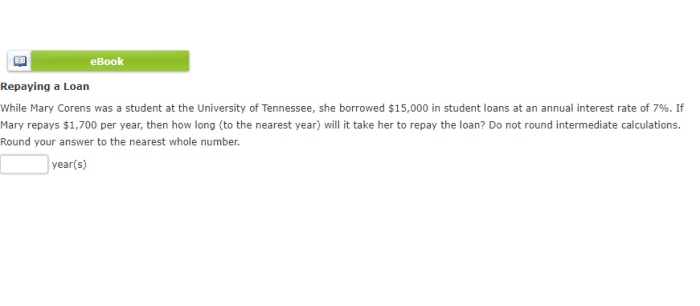

Navigating the complexities of student loan repayment can feel overwhelming. The time it takes to become debt-free depends on a multitude of factors, from the initial loan amount and interest rate to the chosen repayment plan and any extra payments made. Understanding these variables is crucial for developing a realistic repayment strategy and achieving financial freedom sooner. This guide will explore the key elements influencing student loan repayment timelines, providing practical tools and strategies to help you estimate your repayment duration and accelerate your progress towards financial independence. We’ll delve into different repayment plans, the impact of interest rates, and Read More …