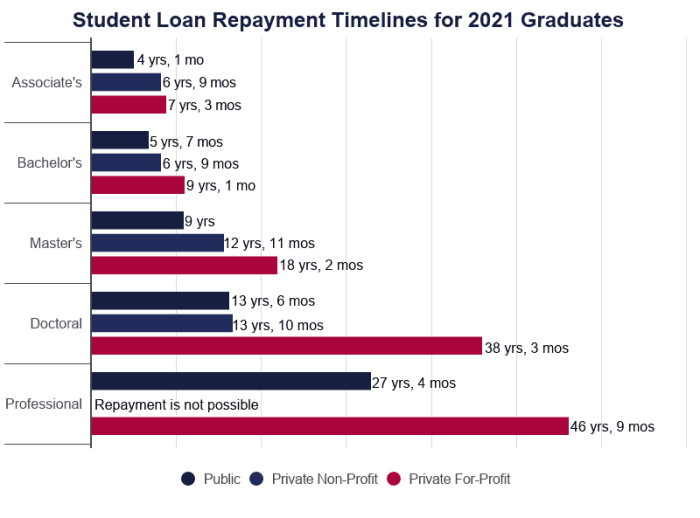

The pursuit of higher education often involves a significant financial commitment. Understanding the various types of student loans available is crucial for making informed decisions that align with your financial goals and circumstances. This guide delves into the complexities of federal and private student loans, exploring their nuances, benefits, and potential drawbacks to empower you with the knowledge necessary for responsible borrowing. From the intricacies of subsidized and unsubsidized federal loans to the considerations surrounding private loan options, we’ll unravel the key differences, highlighting factors such as interest rates, repayment plans, and eligibility criteria. We will also examine loan consolidation Read More …