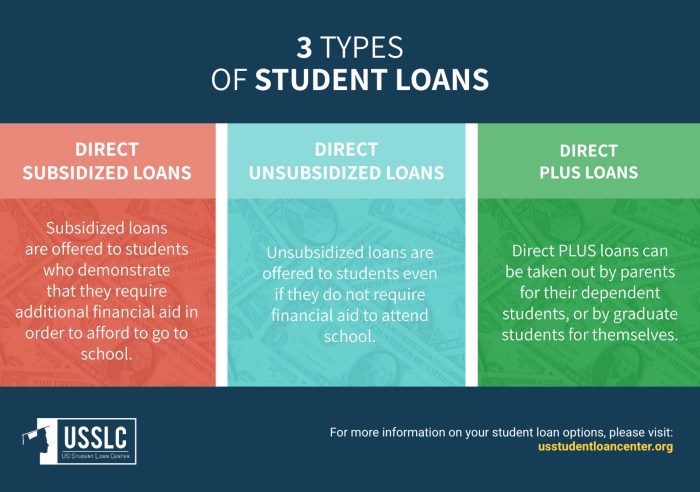

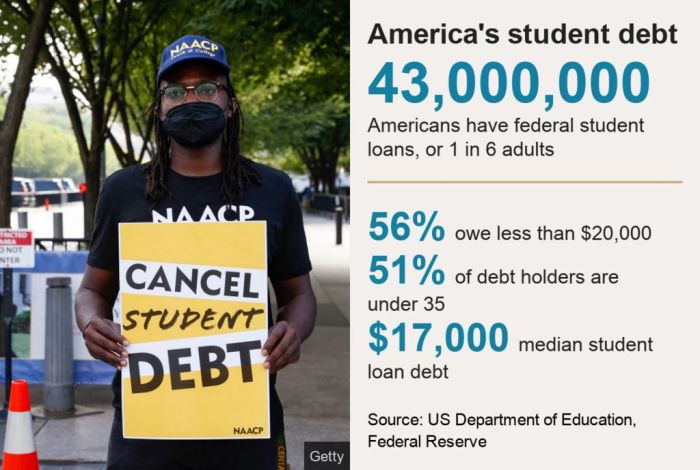

The decision to stop paying student loans is a significant one, fraught with both immediate and long-term consequences. This exploration delves into the multifaceted implications of this choice, examining the legal ramifications, financial repercussions, and the often-overlooked emotional toll. We will navigate the complexities of navigating loan servicers, exploring alternative solutions, and understanding the broader societal impact of student loan debt. From understanding the potential for wage garnishment and credit damage to exploring options like income-driven repayment plans and debt consolidation, we aim to provide a comprehensive overview. We will also address the psychological burden of significant debt and offer Read More …