Securing funding for higher education is a crucial step for many aspiring students. Navigating the complexities of student loans, however, can feel overwhelming. This guide provides a clear and concise overview of the process, addressing eligibility requirements, financial need assessments, and the various types of loans available. We’ll explore the factors influencing loan amounts, the role of credit history, and strategies for maximizing your chances of approval. Understanding these elements empowers you to make informed decisions about financing your education. From understanding the FAFSA to comparing federal and private loan options, we’ll demystify the process, offering practical advice and resources Read More …

Tag: loan eligibility

PNC Student Loan Rates A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when trying to understand the intricacies of interest rates. This guide delves into PNC student loan rates, providing a clear and concise overview to help you make informed decisions about your education financing. We’ll explore various loan types, repayment plans, associated fees, and eligibility criteria, empowering you to confidently manage your student loan journey. Understanding your options is key to successful financial planning. We’ll compare PNC’s offerings to those of other lenders, analyze the factors influencing interest rates, and offer practical strategies for managing your loans effectively. Whether you’re a Read More …

Navy Federal Private Student Loans A Comprehensive Guide

Navigating the world of student loans can be daunting, especially when considering private options. This guide delves into the specifics of Navy Federal private student loans, providing a clear understanding of eligibility requirements, interest rates, repayment plans, and the application process. We’ll compare them to federal loans and other private lenders, highlighting potential benefits and risks to help you make informed decisions about your educational financing. Understanding the nuances of Navy Federal’s offerings is crucial for prospective borrowers. This in-depth analysis aims to equip you with the knowledge needed to confidently assess whether a Navy Federal private student loan aligns Read More …

How Do You Qualify for a Student Loan?

Securing a student loan can be a pivotal step towards higher education, but understanding the qualification process is crucial. Navigating the complexities of federal and private loans, credit scores, and required documentation can feel overwhelming. This guide provides a clear and concise overview, empowering you to confidently pursue your educational goals. From eligibility criteria and necessary paperwork to understanding the impact of your credit history and exploring various loan options, we’ll demystify the entire student loan application process. We’ll compare federal and private loans, highlighting their key differences and helping you choose the best option for your individual circumstances. We’ll Read More …

How Do You Qualify for Student Loans?

Securing funding for higher education is a crucial step for many aspiring students. Understanding the qualification process for student loans, however, can feel overwhelming. This guide navigates the complexities of eligibility, from credit scores and financial need to enrollment status and loan types, providing a clear path towards accessing the financial aid you need to pursue your academic goals. The journey to securing student loans involves more than just filling out an application. Factors like your credit history, income, and the type of degree you’re pursuing all play a significant role in determining your eligibility. This guide aims to demystify Read More …

Freddie Mac Guidelines for Student Loans

Navigating the complexities of student loan financing can be daunting. Understanding Freddie Mac’s role in this process is crucial for both borrowers and lenders. This guide delves into the key aspects of Freddie Mac guidelines, providing clarity on eligibility requirements, loan terms, and default management procedures. We aim to demystify the process and empower you with the knowledge needed to make informed decisions. Freddie Mac, a government-sponsored enterprise, plays a significant role in the secondary market for student loans. By purchasing loans from lenders, Freddie Mac helps to free up capital for lenders to originate more loans, thereby increasing the Read More …

Do Student Loans Need Cosigners?

Navigating the complex world of student loans can be daunting, particularly when grappling with the question of cosigners. This exploration delves into the intricacies of federal and private student loans, examining when a cosigner is required and the implications for both the student and the cosigner. We will explore the factors influencing lender decisions, including credit history and loan amounts, and offer strategies to potentially avoid the need for a cosigner. Understanding the nuances of cosigner requirements is crucial for prospective students to make informed decisions about financing their education. This guide provides a clear overview of the process, empowering Read More …

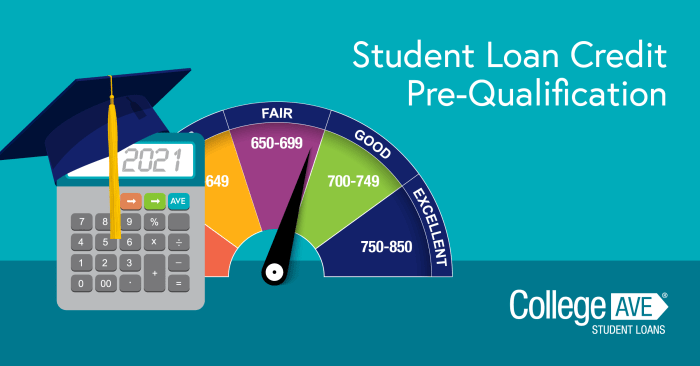

Credit Score Needed for Student Loan Without Cosigner

Securing a student loan without a cosigner can feel daunting, especially if your credit score isn’t stellar. Lenders assess risk, and a strong credit history significantly influences your eligibility and the interest rate you’ll receive. This guide explores the credit score requirements for student loans without cosigners, offering strategies to improve your chances of approval and outlining alternative financing options if needed. We’ll delve into the specifics of various loan types, highlighting the crucial role of your credit score, income, and financial history. Understanding these factors empowers you to navigate the student loan application process effectively and make informed decisions Read More …

Can I Get a Student Loan With a Felony?

Securing a student loan with a felony conviction can feel like navigating a complex maze. The path forward isn’t always clear, as lenders assess applicants based on various factors beyond just academic merit. This exploration delves into the intricacies of loan eligibility for individuals with criminal records, examining the types of felonies that impact applications, the application process itself, and alternative funding options when traditional loans are unavailable. We’ll also address legal and ethical considerations, offering a comprehensive guide to help you understand your options. Understanding the nuances of how a felony affects your loan application requires careful consideration of Read More …

Pre-Approval Student Loans A Comprehensive Guide

Navigating the complex world of student loans can feel overwhelming, but understanding the pre-approval process can significantly simplify the journey. Pre-approval offers a strategic advantage, allowing prospective borrowers to explore loan options and understand their eligibility before committing to a formal application. This empowers students to make informed decisions and potentially secure better loan terms. This guide delves into the intricacies of pre-approval for student loans, examining the process, factors influencing eligibility, and the differences between federal and private loans. We’ll explore how pre-approval compares to pre-qualification, providing a step-by-step guide to help you navigate this crucial stage of financing Read More …