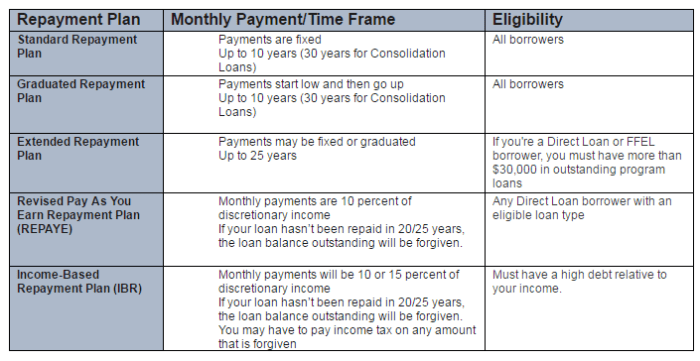

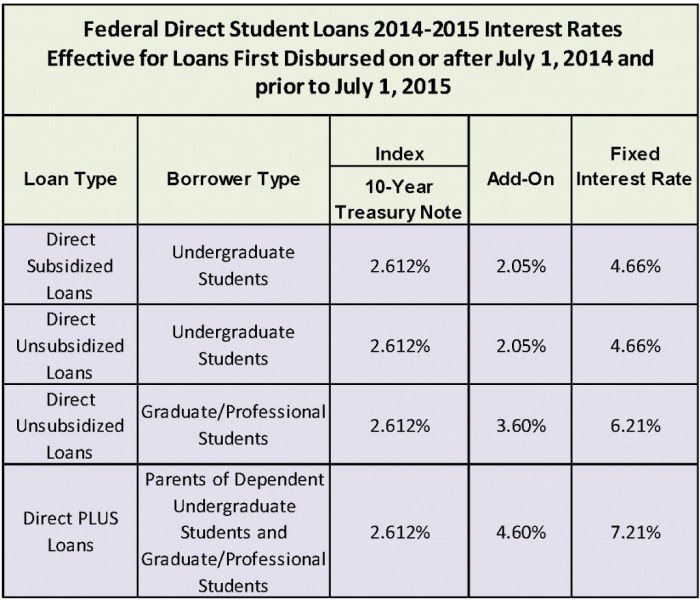

The resumption of student loan repayments marks a significant moment for millions of borrowers across the nation. After an extended pause implemented to mitigate the economic fallout of the pandemic, the restart date has finally been announced, ushering in a period of renewed financial obligations and uncertainty for many. This period requires careful consideration of repayment plans, potential financial strain, and the overall economic implications. Understanding the government’s support systems and resources available to struggling borrowers is crucial. This analysis delves into the official announcement, its impact on borrowers across various demographics, the supporting government policies, and the wider economic Read More …