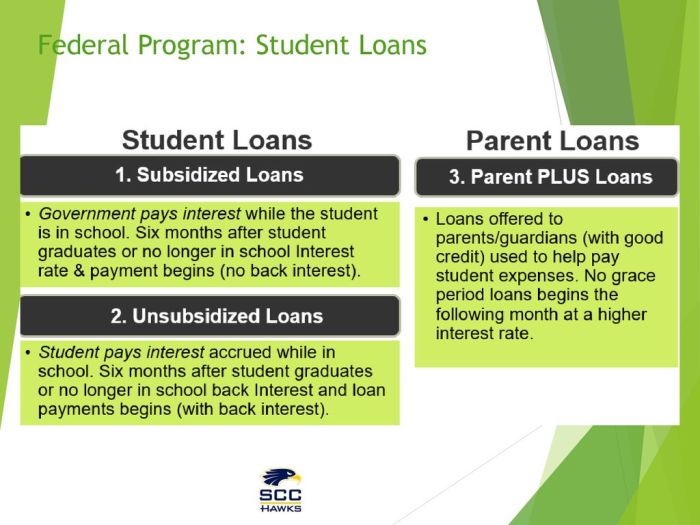

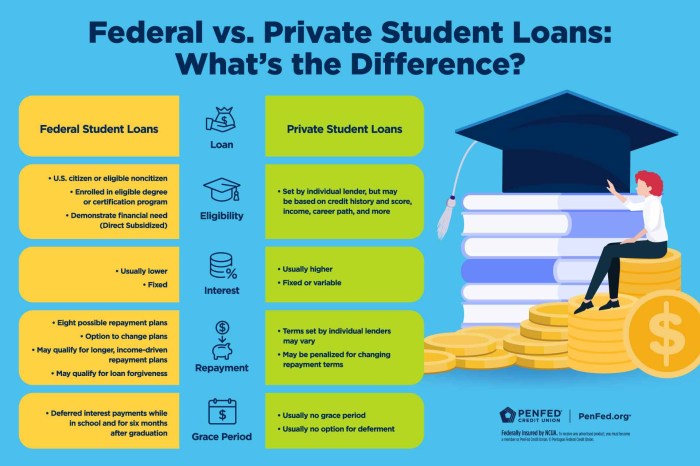

Navigating the complex world of student financial aid loans can feel overwhelming. From understanding the different loan types and application processes to managing repayment and exploring forgiveness options, the journey requires careful planning and informed decision-making. This guide aims to demystify the process, providing you with the knowledge and tools to make sound financial choices for your education. This comprehensive resource covers various aspects of student financial aid loans, including federal and private loan options, application procedures, repayment strategies, and the long-term financial implications of student loan debt. We will explore effective debt management techniques, government programs, and potential avenues Read More …