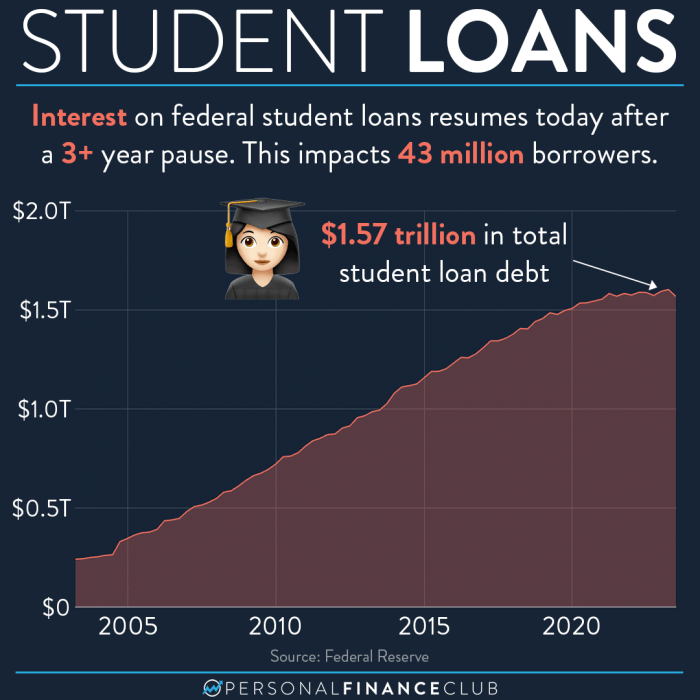

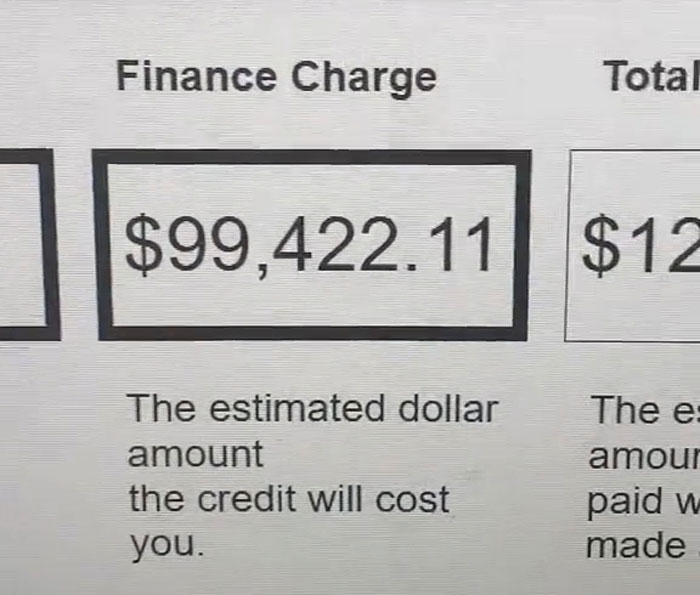

Navigating the complexities of student loan repayment can feel overwhelming. Understanding your loan terms, assessing your financial situation, and strategically prioritizing repayment are crucial steps toward financial freedom. This guide provides a comprehensive roadmap, exploring various repayment plans, budgeting strategies, and debt repayment methods to help you make informed decisions and effectively manage your student loan debt. From understanding income-driven repayment plans versus standard plans to exploring options like refinancing and loan forgiveness programs, we’ll cover the essential elements of creating a personalized repayment strategy. We’ll also delve into the long-term financial implications of your choices, emphasizing the impact on Read More …