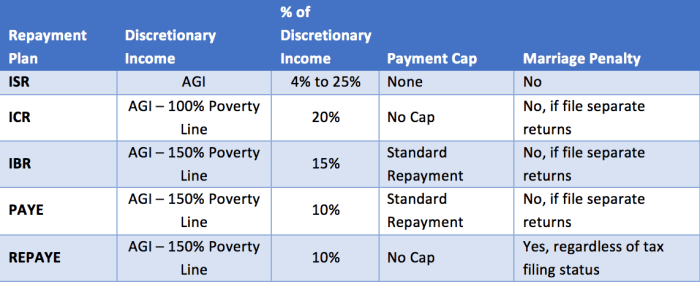

Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly alleviate the burden. IBR plans offer a pathway to manageable monthly payments based on your income and family size, potentially leading to loan forgiveness after a set period. This guide delves into the intricacies of IBR, exploring eligibility criteria, calculation methods, tax implications, and long-term financial effects. We’ll compare IBR to other repayment options, address common challenges, and equip you with the knowledge to make informed decisions about your student loan debt. From understanding the different types of IBR plans and their Read More …