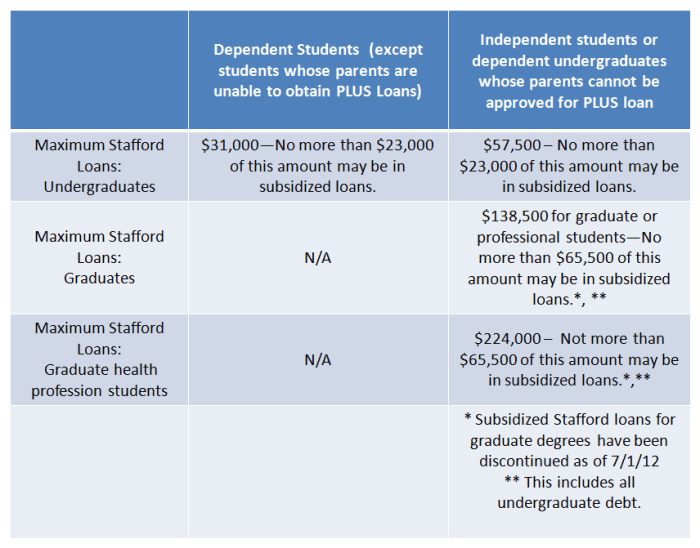

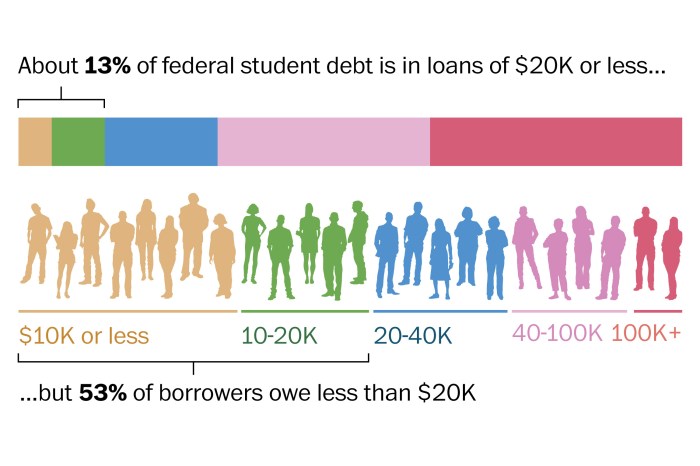

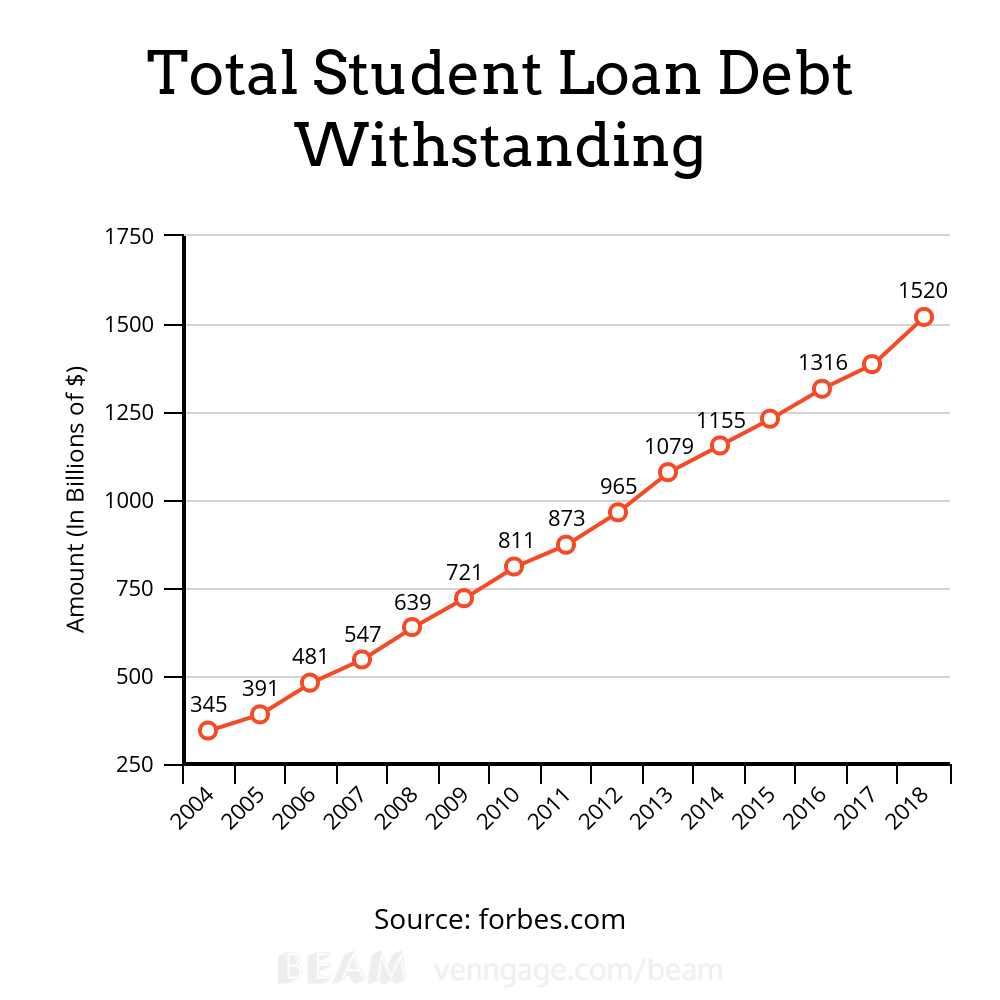

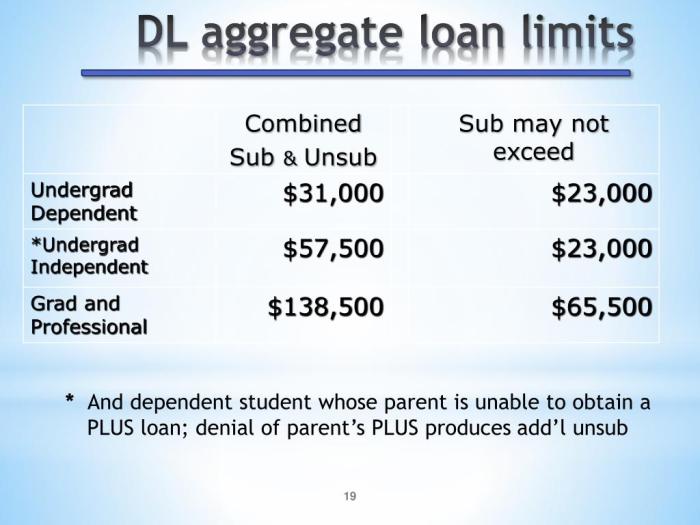

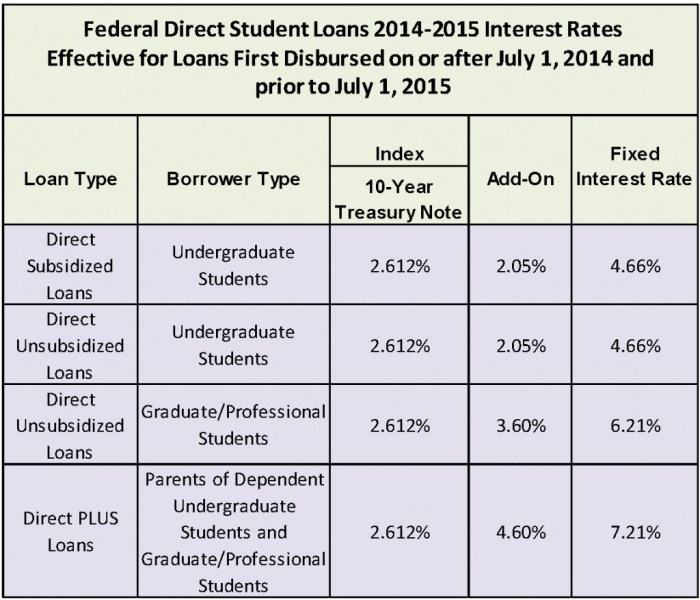

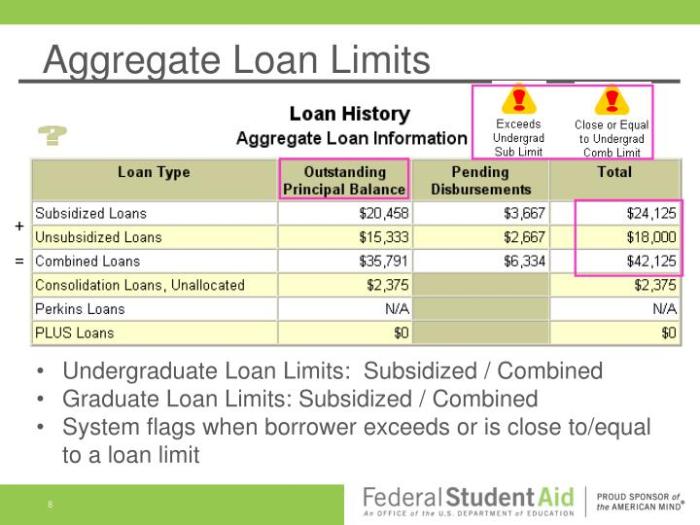

Navigating the complexities of financing higher education can be daunting, especially understanding the limitations placed on borrowing. This guide delves into the crucial topic of aggregate loan limits for undergraduate students, clarifying the rules and regulations governing how much students can borrow for their education. We will explore the factors that influence these limits, the potential consequences of exceeding them, and the resources available to help students make informed financial decisions. Understanding your aggregate loan limit is paramount to responsible financial planning during and after college. This involves knowing the different types of federal student loans, how your dependency status Read More …