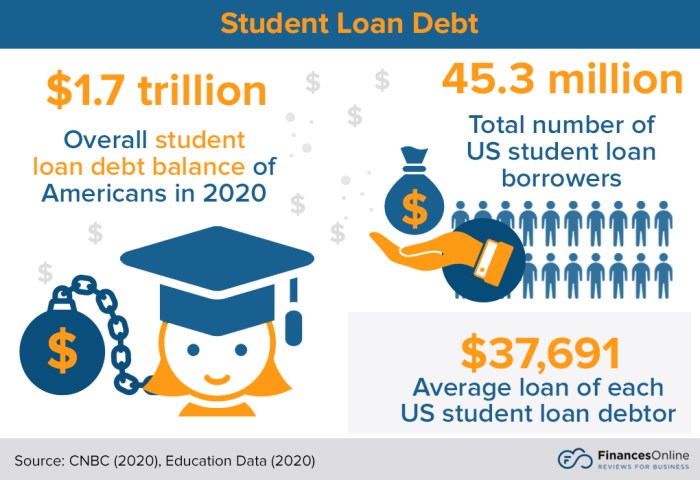

Navigating the complexities of higher education often involves understanding the financial landscape. A crucial element of this is determining the maximum amount of student loans you can borrow each year. This impacts not only your immediate ability to fund your education but also significantly shapes your long-term financial well-being. Understanding the limits, both federal and private, is essential for responsible borrowing and future financial stability. This guide delves into the specifics of federal and private student loan limits, exploring the factors that influence eligibility and the potential consequences of exceeding borrowing limits. We’ll examine how factors like your student status Read More …