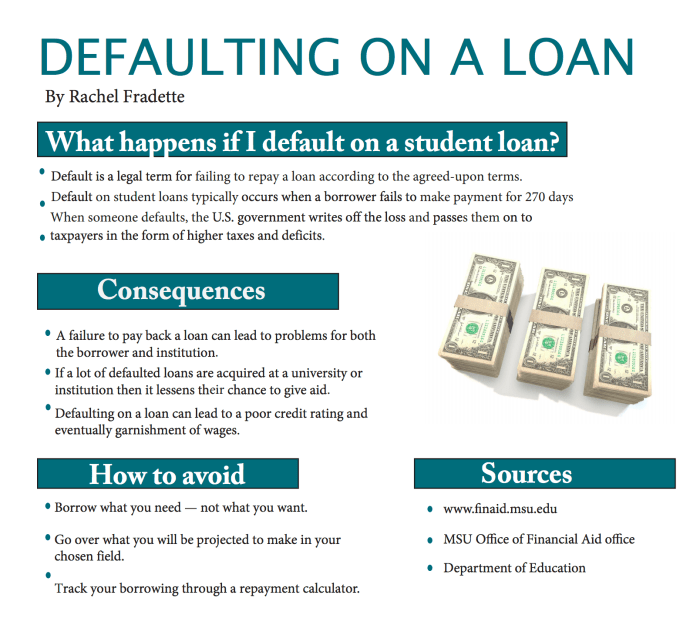

Navigating the complexities of student loan default can feel overwhelming, but understanding your options is the first step towards financial recovery. This guide provides a clear path to resolving defaulted student loans, exploring various strategies and resources available to help you regain control of your finances. We’ll cover everything from identifying your loan servicer and understanding rehabilitation options to exploring consolidation, income-driven repayment plans, and forgiveness programs. The journey out of student loan default requires careful planning and a proactive approach. This guide aims to equip you with the knowledge and resources necessary to make informed decisions and successfully navigate Read More …