Navigating the complexities of student loan repayment can feel overwhelming, especially when considering potential tax benefits. Understanding the maximum student loan interest deduction is crucial for borrowers seeking to minimize their tax burden. This guide provides a clear and concise overview of eligibility requirements, calculation methods, and strategies for maximizing this valuable deduction. We’ll explore how recent tax reforms have impacted the deduction and compare it to other student loan assistance programs, empowering you to make informed financial decisions. This exploration delves into the intricacies of the maximum student loan deduction, covering everything from determining eligibility based on your Modified Read More …

Tag: MAGI

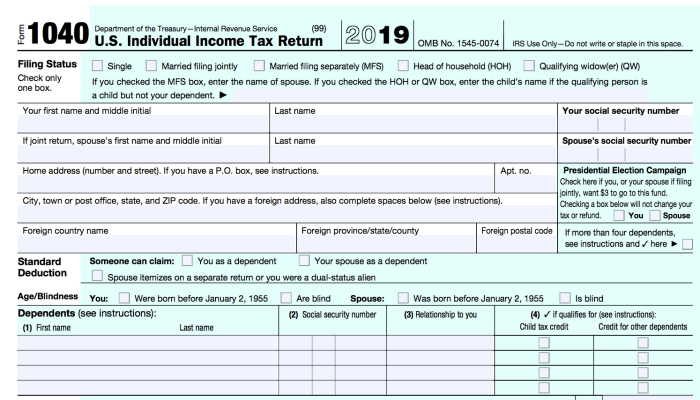

Credit for Student Loan Interest Deduction

Navigating the complexities of student loan debt can feel overwhelming, but understanding the potential tax benefits available can significantly ease the burden. This guide delves into the student loan interest deduction, a valuable tool for taxpayers aiming to reduce their tax liability. We’ll explore eligibility criteria, calculation methods, and strategies for maximizing your deduction, ultimately empowering you to make informed financial decisions. From understanding the income limitations and modified adjusted gross income (MAGI) thresholds to mastering the calculation process and navigating different repayment plans, we’ll provide a comprehensive overview. We’ll also address common misconceptions and pitfalls, ensuring you confidently claim Read More …

Student Loan Interest Deduction Income Limits

Navigating the complexities of student loan repayment can be daunting, especially when considering potential tax benefits. Understanding the student loan interest deduction and its associated income limits is crucial for maximizing your tax savings. This deduction offers a valuable opportunity to reduce your tax burden, but eligibility hinges on factors such as your modified adjusted gross income (MAGI) and filing status. This guide will clarify these complexities, empowering you to confidently navigate the process and potentially claim this beneficial deduction. We’ll explore the current income limitations for various filing statuses, delve into the calculation of MAGI, and examine how changes Read More …

Understanding the Limit for Student Loan Interest Deduction: A Comprehensive Guide

Navigating the complexities of student loan repayment is a significant challenge for many, and understanding the available tax benefits can make a considerable difference. This guide delves into the student loan interest deduction, a valuable tax break designed to ease the financial burden of higher education. We’ll explore the eligibility criteria, maximum deduction amounts, and the impact of Modified Adjusted Gross Income (MAGI) on your potential savings. By understanding the intricacies of this deduction, you can maximize your tax benefits and effectively manage your student loan debt. We will cover key aspects such as identifying eligible loan types, accurate record-keeping Read More …

Understanding the Student Loan Interest Deduction Cap: A Comprehensive Guide

Navigating the complexities of student loan repayment is a significant challenge for many Americans. A crucial aspect of this journey involves understanding the student loan interest deduction, a tax benefit designed to alleviate the financial burden of higher education. However, this deduction isn’t unlimited; it’s subject to a cap, significantly impacting the amount of tax relief borrowers can claim. This guide delves into the history, eligibility, impact, and potential reforms surrounding this vital student loan interest deduction cap, providing a comprehensive overview for both current and prospective borrowers. We will explore the evolution of the cap, examining legislative changes and Read More …