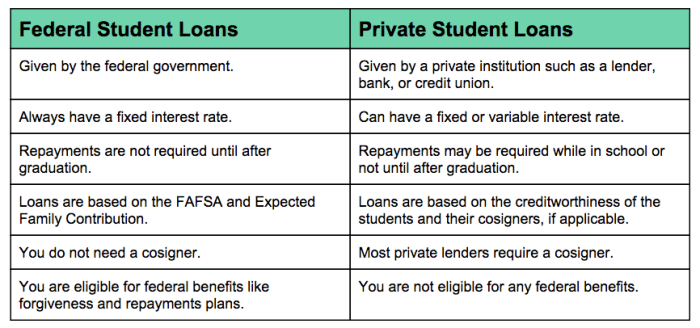

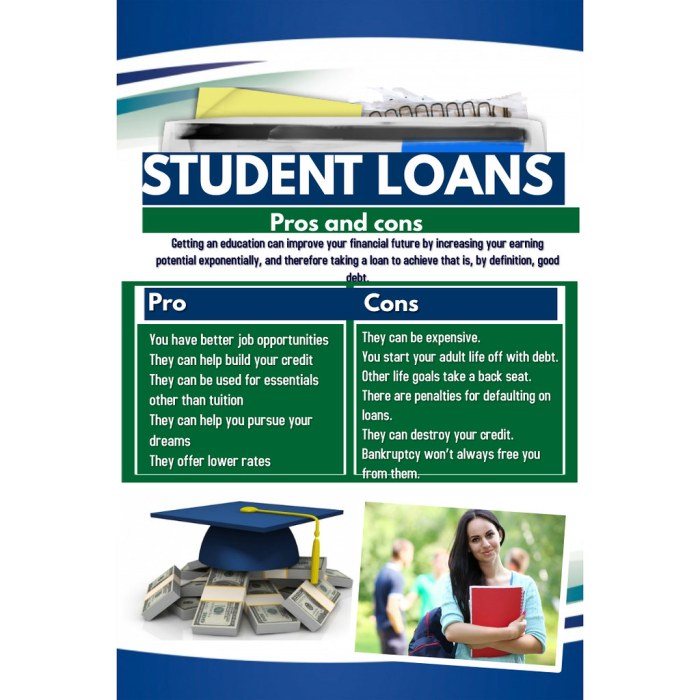

Securing student loans can be challenging, especially for students lacking established credit or a cosigner. Traditional lenders often rely heavily on credit history and cosigner guarantees to assess risk. This absence can create significant hurdles for those starting their higher education journey without a financial safety net. This guide navigates the complexities of obtaining student loans under these circumstances, exploring alternative options and strategies to improve your chances of approval. We’ll delve into the intricacies of federal loan programs, comparing their eligibility requirements, application processes, and the advantages and disadvantages they offer. We’ll also discuss methods for building credit, exploring Read More …