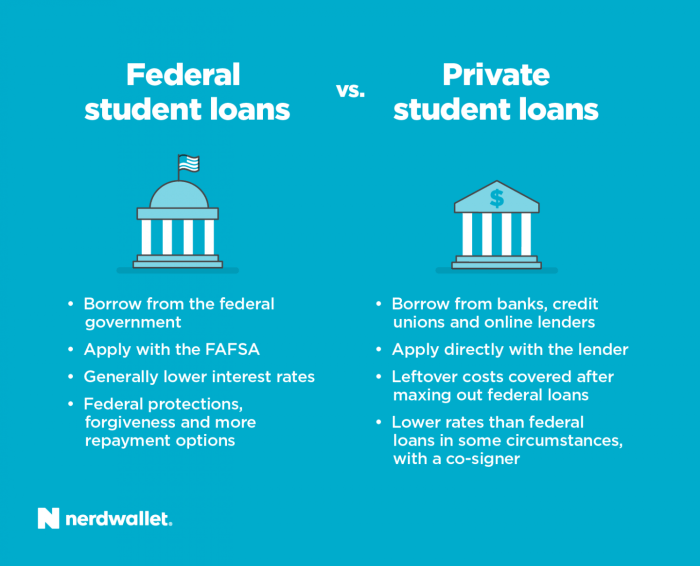

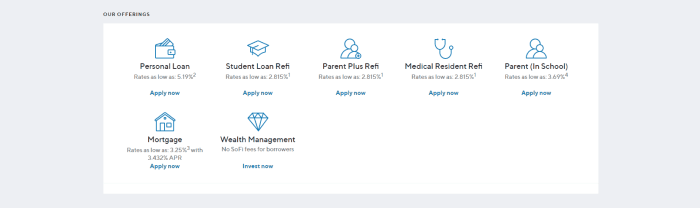

Navigating the world of student loan refinancing can feel overwhelming. This guide delves into Sofi’s student loan refinance options, examining customer experiences, interest rates, repayment plans, and comparing them to competitors. We’ll explore the application process, eligibility requirements, and ultimately help you decide if Sofi is the right choice for your financial needs. From analyzing countless Sofi refinance student loan reviews, we’ve compiled a detailed analysis covering everything from the application’s simplicity to the responsiveness of their customer support. We aim to provide a balanced perspective, highlighting both the advantages and potential drawbacks to help you make an informed decision. Read More …