The allure of quick student loan approvals can be tempting, especially amidst the financial pressures of higher education. However, the landscape of student lending is fraught with potential pitfalls, particularly when dealing with uncertified lenders. These entities, often operating outside established regulatory frameworks, may lure borrowers with seemingly attractive terms, only to expose them to significant financial and legal risks. This exploration delves into the complexities of navigating this treacherous terrain, equipping students with the knowledge to make informed decisions and avoid predatory lending practices. Understanding the differences between certified and uncertified lenders is crucial for securing a financially sound Read More …

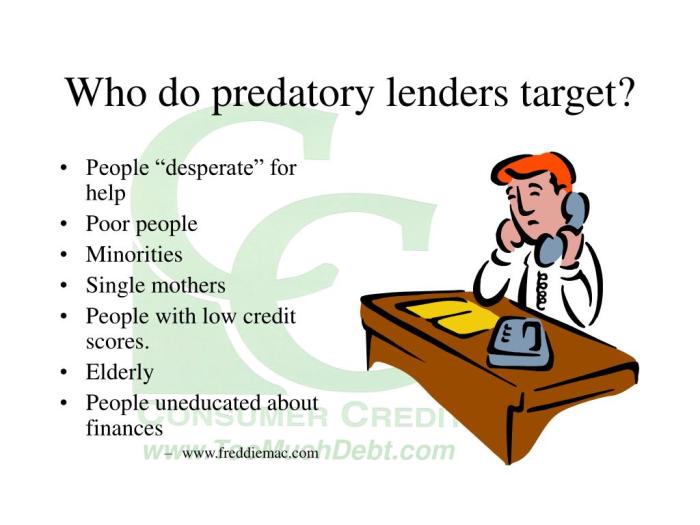

Tag: predatory lending

Student Loan Consolidation Scam Avoid the Trap

Navigating the complexities of student loan repayment can be daunting, and the promise of consolidation often seems like a lifeline. However, lurking beneath the surface are predatory schemes designed to exploit vulnerable borrowers. Student loan consolidation scams prey on individuals struggling with debt, offering false hope of lower payments and manageable repayment plans. Understanding the tactics employed by these scammers is crucial to protecting yourself from financial ruin. These scams often involve deceptive marketing, high-pressure sales tactics, and hidden fees that quickly escalate the borrower’s debt burden. The consequences of falling victim to such a scheme can be devastating, leading Read More …

Student Loan Predatory Lending A Comprehensive Overview

The pursuit of higher education often involves navigating the complex landscape of student loans. While these loans can be a crucial stepping stone to a brighter future, the shadow of predatory lending looms large, trapping unsuspecting borrowers in a cycle of crippling debt. This exploration delves into the deceptive practices employed by some lenders, examining the devastating consequences for individuals and society as a whole. We’ll uncover the warning signs, explore legal protections, and offer strategies for responsible borrowing. Understanding the intricacies of student loan predatory lending is paramount. This involves recognizing the subtle differences between legitimate and exploitative loan Read More …

Student Loan Consolidation Fraud Avoiding the Traps

Navigating the complexities of student loan repayment can be daunting, and the allure of consolidation offers often seems too good to be true. Unfortunately, this allure frequently masks predatory schemes designed to exploit vulnerable borrowers. Understanding the tactics employed by fraudulent consolidation companies is crucial to protecting your financial future and avoiding the devastating consequences of falling victim to these scams. This guide will equip you with the knowledge and tools necessary to make informed decisions and safeguard your finances. Student loan consolidation fraud encompasses a range of deceptive practices, from companies promising unrealistically low interest rates to those demanding Read More …

Student Loan Class Action Lawsuit Overview

The crippling weight of student loan debt has become a defining characteristic of the modern American experience. Millions grapple with repayments, often facing insurmountable challenges. This pervasive issue has fueled a surge in student loan class action lawsuits, offering a potential lifeline for borrowers overwhelmed by debt. These lawsuits challenge lending practices, alleging predatory behavior, deceptive marketing, and servicing errors. Understanding the complexities of these cases is crucial for anyone navigating the student loan system. This overview explores the historical context of the student loan debt crisis, examining the contributing factors that have led to its current state. We delve Read More …

Are Student Loans Predatory?

The question of whether student loans are predatory is a complex one, impacting millions globally. While providing access to higher education, these loans often come with high interest rates, opaque terms, and aggressive marketing tactics targeting vulnerable students. This exploration delves into the characteristics of predatory lending, examining specific practices within the student loan industry and their consequences for borrowers. We will analyze the role of government regulation and the broader societal implications of mounting student debt. This analysis considers various aspects, including the impact of high-interest rates and repayment plans, the ethical implications of targeted marketing towards financially vulnerable Read More …

Did You Pay Too Much for Your Student Loan? Understanding Overpayment and Finding Solutions

The weight of student loan debt is a significant concern for many recent graduates and current students. Millions grapple with the belief that they’ve paid—or are paying—excessively for their education. This isn’t simply a matter of regret; it often stems from complex loan agreements, hidden fees, and a lack of financial literacy. This exploration delves into the pervasive issue of student loan overpayment, examining its causes, consequences, and potential remedies. We’ll examine the various factors contributing to this perception, from aggressive lending practices to a lack of understanding of loan terms. We’ll also explore strategies for improving financial literacy, alternative Read More …