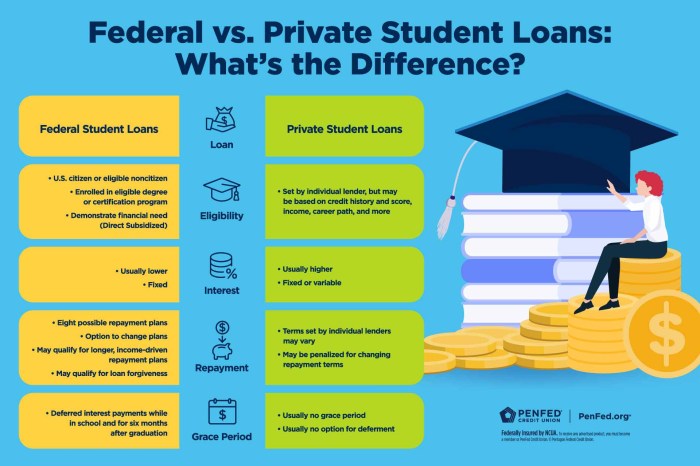

Navigating the world of student loans can feel overwhelming, a labyrinth of interest rates, repayment plans, and lender options. This guide aims to simplify the process, empowering you to make informed decisions about financing your education. From understanding your eligibility and exploring different loan types to avoiding potential scams and planning for repayment, we’ll cover all the essential steps to ensure a smooth and successful journey. We’ll delve into the key differences between federal and private loans, highlighting the advantages and disadvantages of each. You’ll learn how to compare lenders, understand loan terms, and create a realistic repayment budget. Crucially, Read More …