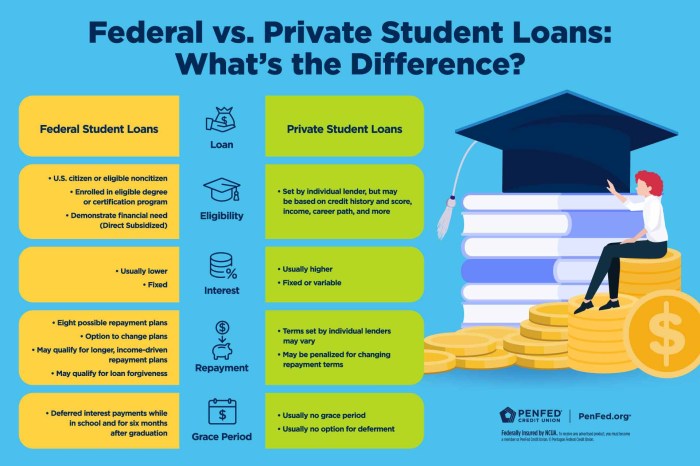

Navigating the complexities of higher education financing can be daunting, especially when considering private student loan options. This guide delves into Prodigy Private Student Loans, providing a detailed analysis of eligibility requirements, interest rates, repayment plans, and the application process. We’ll compare Prodigy to its competitors and federal loan options, highlighting key differences and potential risks to help you make an informed decision. Understanding the nuances of private student loans is crucial for responsible borrowing. This exploration aims to equip prospective borrowers with the knowledge necessary to confidently assess whether a Prodigy Private Student Loan aligns with their financial goals Read More …