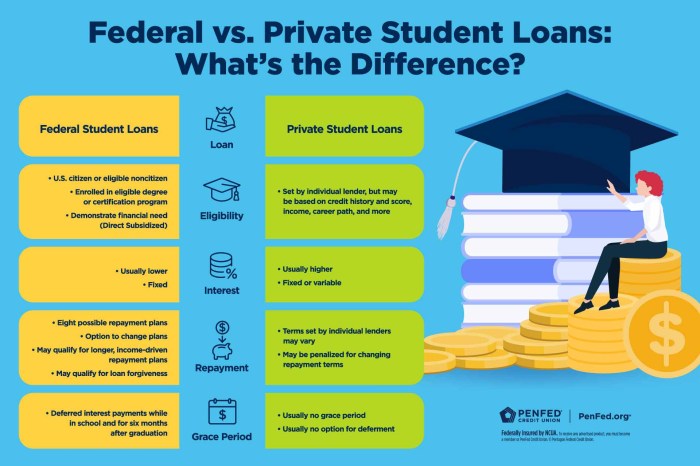

Navigating the complex world of higher education financing often leads students and their families to explore private student loan options. Direct-to-consumer private student loans, offered directly by lenders without intermediaries, present a distinct avenue for securing funding. This approach offers potential advantages such as streamlined applications and personalized loan terms, but also introduces considerations regarding interest rates, repayment options, and overall financial responsibility. Understanding the market landscape, borrower demographics, and regulatory frameworks surrounding these loans is crucial for making informed decisions. This exploration delves into the intricacies of the direct-to-consumer private student loan market, examining the competitive landscape, borrower needs, Read More …