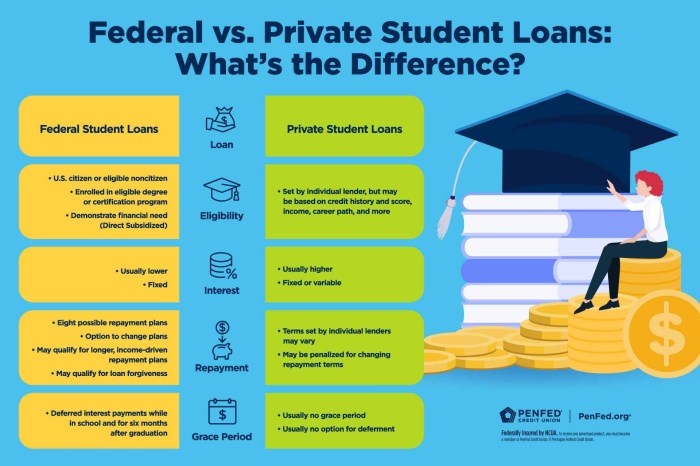

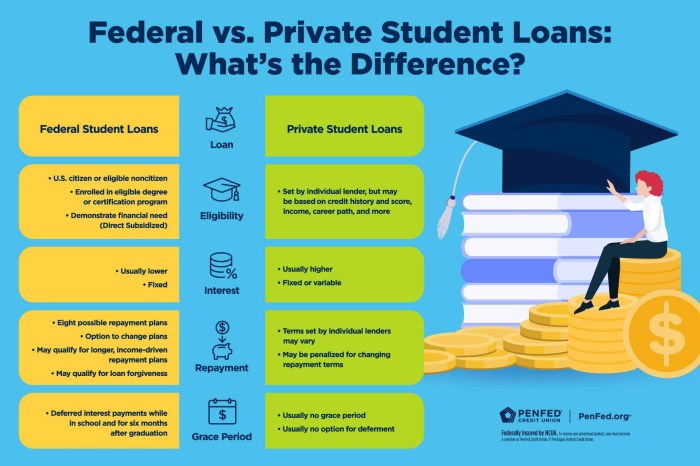

Navigating the complexities of student loan debt can feel overwhelming, especially when juggling both private and federal loans. This guide provides a clear path toward understanding the process of consolidating private student loans into federal loans, outlining the benefits, drawbacks, and crucial steps involved. We’ll explore eligibility criteria, walk you through the application process, and help you determine if consolidation is the right financial strategy for your unique circumstances. Many borrowers find themselves burdened by multiple private student loans with varying interest rates and repayment terms. Consolidating these loans into a single federal loan can simplify repayment, potentially lower monthly Read More …