Navigating the world of student loans can feel overwhelming, especially when considering private options. This guide delves into the intricacies of Discover student private loans, providing a clear understanding of eligibility, application processes, financial implications, and responsible borrowing strategies. We’ll explore the various loan types, compare interest rates and repayment terms, and offer insights into avoiding predatory lending practices. Ultimately, our aim is to empower you with the knowledge needed to make informed decisions about financing your education. From understanding the nuances of interest rates and repayment plans to developing effective strategies for managing your debt post-graduation, this guide covers Read More …

Tag: private student loans

Discover Student Loan A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, but understanding your options is key to a successful financial future. This guide delves into the specifics of Discover student loans, providing a clear and concise overview of their various offerings, application processes, repayment strategies, and potential challenges. We’ll equip you with the knowledge to make informed decisions about your educational financing. From eligibility requirements and interest rates to repayment plans and customer service support, we’ll cover all the essential aspects of Discover student loans. We will also compare them to other lenders and loan types, helping you determine if a Read More …

Credit Student Loans A Comprehensive Guide

Navigating the complex world of student loans can feel overwhelming, especially when faced with the choice between federal and private options, varying repayment plans, and the long-term financial implications. This guide provides a clear and concise overview of credit student loans, equipping you with the knowledge to make informed decisions about financing your education and managing your debt effectively. We’ll explore everything from eligibility and application processes to loan forgiveness programs and strategies for minimizing the impact of student loan debt on your future financial well-being. Understanding the nuances of interest rates, loan terms, and available repayment options is crucial Read More …

Discover Student Loans A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, but understanding your options is key to a successful academic journey. This guide delves into Discover student loans, exploring their various types, application processes, and management strategies. We’ll compare them to other lenders and financing options, equipping you with the knowledge to make informed decisions about your education funding. From eligibility requirements and interest rates to repayment plans and potential challenges, we’ll cover all the essential aspects of Discover student loans. We aim to provide a clear, concise, and practical resource to help you confidently manage your student loan experience. Understanding Read More …

Current Rates for Student Loans A Comprehensive Guide

Navigating the complex landscape of student loan financing requires a clear understanding of current interest rates. This guide delves into the intricacies of both federal and private student loans, examining the factors that influence rates and providing crucial information to help borrowers make informed decisions. We’ll explore various loan types, repayment plans, and the impact of credit scores, equipping you with the knowledge to secure the most favorable terms possible. From understanding the differences between subsidized and unsubsidized federal loans to comparing the offerings of various private lenders, we aim to demystify the process and empower you to take control Read More …

Cosigner Requirements for Student Loans

Navigating the world of student loans often requires understanding the role of a cosigner. Securing financial aid for higher education can be challenging, and for many students, a cosigner is the key to unlocking access to private loans or even certain federal loan programs. This exploration delves into the intricacies of cosigner requirements, responsibilities, and the alternatives available to those without a cosigner. We will examine the criteria lenders use, the impact on interest rates, and strategies for both students and cosigners to navigate this crucial aspect of student loan financing successfully. This guide aims to provide a comprehensive overview Read More …

Consolidate Private and Federal Student Loans

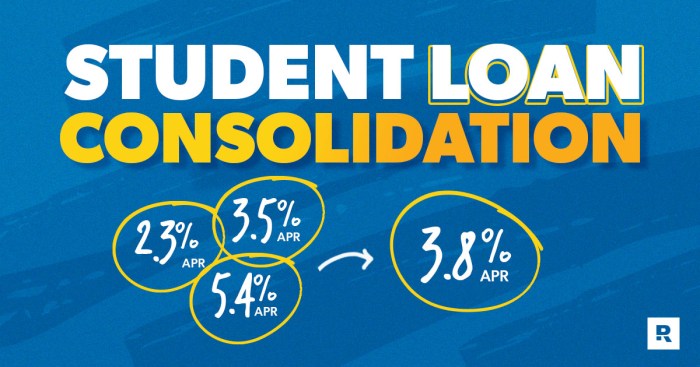

Navigating the complex world of student loan debt can feel overwhelming, especially when juggling both private and federal loans. The prospect of simplifying this financial burden through consolidation is attractive, promising reduced monthly payments and easier management. However, this path isn’t without potential pitfalls. Understanding the intricacies of consolidation, including eligibility requirements, the application process, and potential long-term financial implications, is crucial for making an informed decision. This guide delves into the benefits and drawbacks of consolidating private and federal student loans, providing a comprehensive overview of the process and offering insights to help you determine if consolidation aligns with Read More …

Consolidate a Student Loan A Comprehensive Guide

Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Consolidating your student loans might be the key to simplifying your repayment process and potentially lowering your monthly payments. This guide explores the ins and outs of student loan consolidation, helping you make informed decisions about your financial future. We’ll delve into the various types of consolidation programs available, both federal and private, outlining their eligibility requirements, interest rates, and long-term financial implications. We’ll examine the impact of credit scores and explore different repayment strategies to help you choose Read More …

Comparison of Student Loans A Comprehensive Guide

Navigating the complex world of student loans can feel overwhelming. This guide provides a clear and concise comparison of federal and private student loan options, empowering you to make informed decisions about financing your education. We’ll explore interest rates, repayment plans, forgiveness programs, and the long-term financial implications of student loan debt, equipping you with the knowledge to manage your debt effectively. From understanding the nuances of subsidized versus unsubsidized loans to comparing the various repayment plan options and exploring debt relief programs, this resource aims to demystify the student loan process. We’ll delve into the factors influencing interest rates, Read More …

Consolidating Student Loan Debt A Comprehensive Guide

Navigating the complex world of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Consolidating your student loans might seem like a simple solution, but it’s crucial to carefully weigh the potential benefits against the risks. This guide provides a clear and concise overview of the process, helping you make informed decisions about your financial future. From understanding the different types of consolidation programs available to analyzing the impact on your credit score and overall financial health, we’ll explore the intricacies of student loan consolidation. We’ll also delve into alternative strategies for Read More …