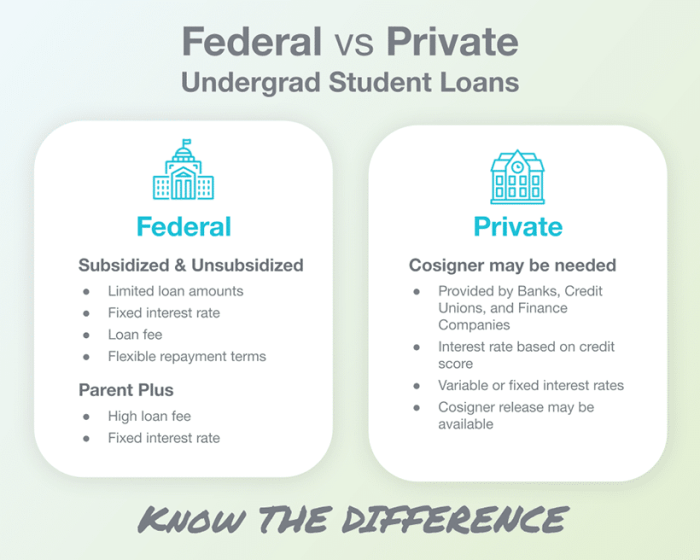

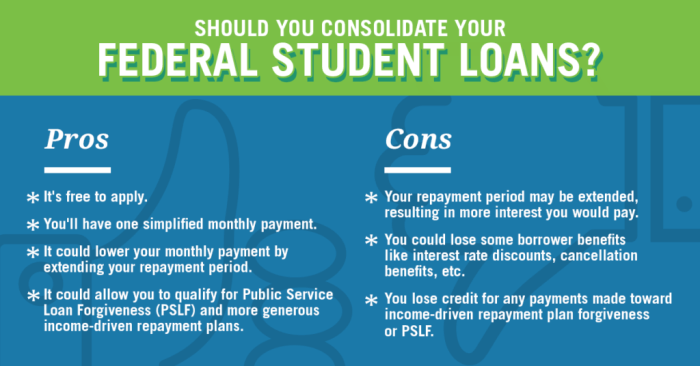

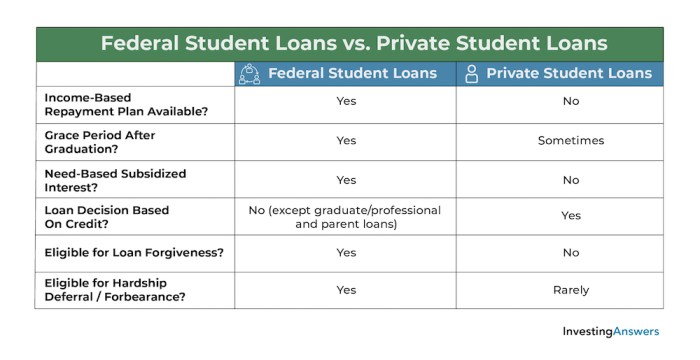

Navigating the world of student loans can feel overwhelming, especially in a large state like Texas. With a plethora of options available, from federal programs to private lenders, understanding the nuances of each loan type is crucial for securing the best financial path for your education. This guide provides a clear and concise overview of the best student loan options in Texas, helping you make informed decisions about financing your future. We will explore the various types of student loans available, including federal and private options, highlighting their respective benefits, drawbacks, and eligibility requirements. We’ll also delve into crucial factors Read More …