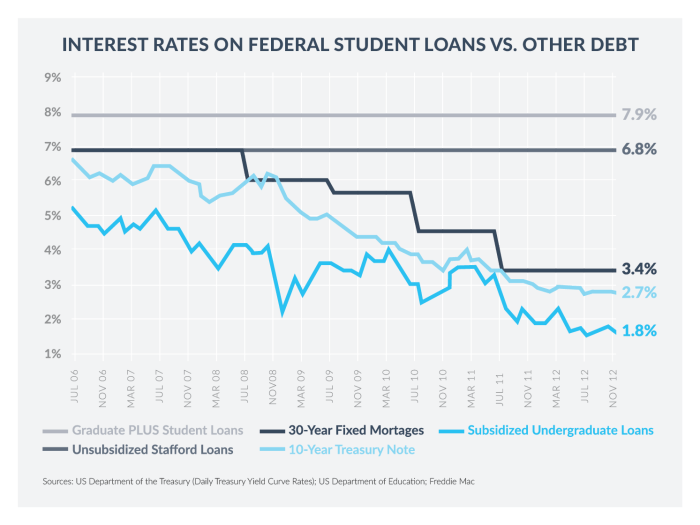

Navigating the world of graduate student loans can feel overwhelming. The sheer number of options—federal loans, private loans, consolidation, and refinancing—often leaves prospective students unsure where to begin. This guide aims to clarify the landscape, offering a comprehensive overview of the various types of student loans available to finance your graduate education, empowering you to make informed decisions about your financial future. Understanding the nuances of each loan type, from interest rates and repayment plans to eligibility criteria and potential fees, is crucial for responsible borrowing. We will explore both federal and private loan options, comparing their advantages and disadvantages Read More …