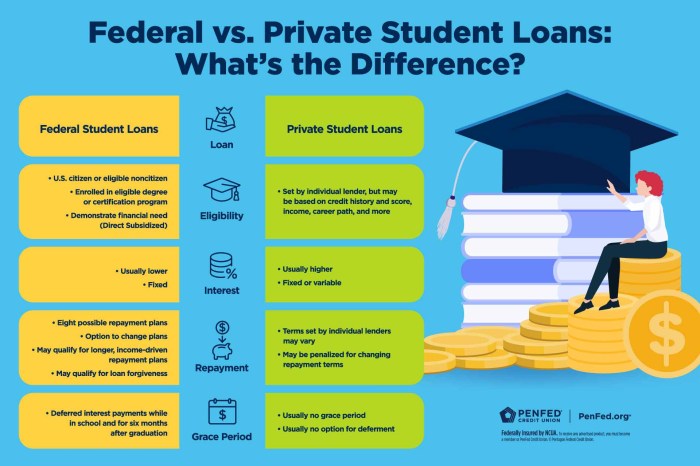

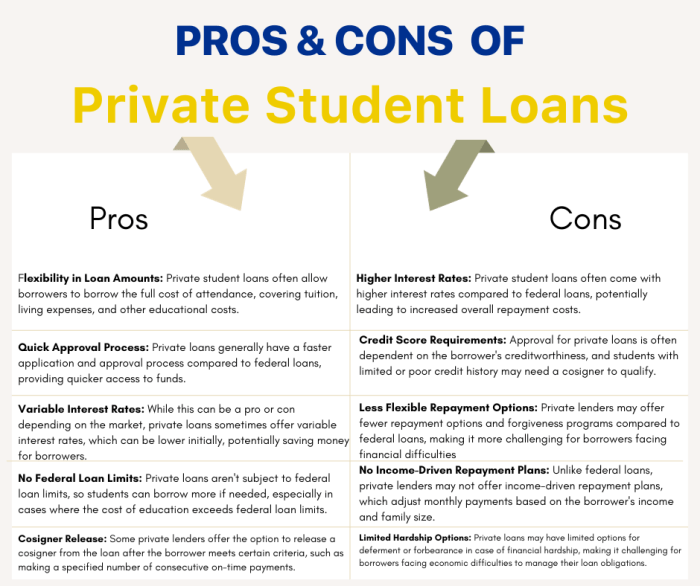

Navigating the world of student loans can feel overwhelming, but understanding the process is key to securing the funding you need for your education. From eligibility requirements to repayment plans, the journey involves several crucial steps. This guide provides a clear, concise roadmap to help you successfully obtain a student loan and manage your finances effectively throughout your academic journey and beyond. This comprehensive guide breaks down the entire process into manageable steps, covering everything from determining your eligibility and choosing the right loan type to understanding repayment options and managing your debt responsibly. We’ll explore both federal and private Read More …