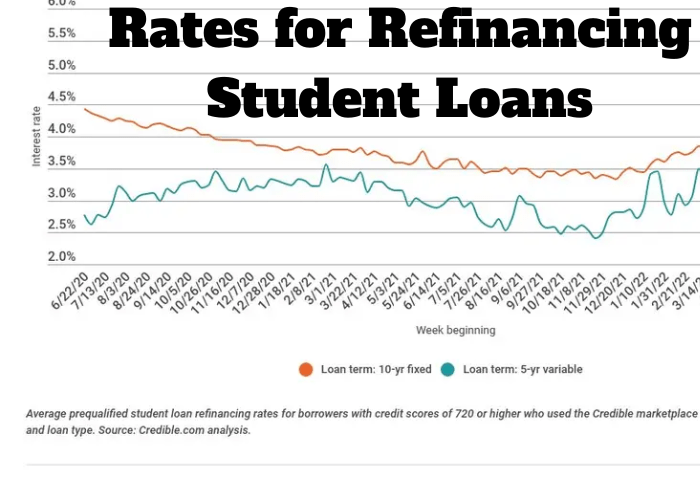

Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to lower monthly payments and faster repayment. This guide delves into PNC’s student loan refinancing options, providing a detailed analysis to help you determine if refinancing with PNC is the right choice for your financial situation. We’ll explore interest rates, fees, repayment plans, and eligibility requirements, comparing PNC’s offerings to those of other major lenders to give you a comprehensive understanding of your options. Understanding the nuances of student loan refinancing is crucial for making informed decisions. Factors like your credit score, loan amount, Read More …