Navigating the world of Sallie Mae student loan payments can feel overwhelming, but understanding your options and available resources is key to successful repayment. This guide provides a comprehensive overview of Sallie Mae’s repayment plans, payment methods, and tools designed to help you manage your student loan debt effectively and efficiently. We’ll explore various repayment strategies, address common concerns about interest accrual and capitalization, and offer insights into managing financial hardship. Ultimately, our aim is to empower you with the knowledge and tools to navigate your student loan journey with confidence. From understanding the nuances of standard, extended, graduated, and Read More …

Tag: refinancing

Private Student Loan Relief Programs Explained

Navigating the complexities of student loan debt can feel overwhelming, especially when faced with private loan repayments. Many borrowers find themselves seeking relief, and understanding the options available is crucial for long-term financial well-being. This guide explores various private student loan relief programs, outlining eligibility criteria, application processes, and potential long-term implications. We’ll also delve into alternative debt management strategies and highlight common scams to avoid. From income-driven repayment plans to forbearance and deferment options, the landscape of private student loan relief is diverse. Each program carries its own set of requirements and consequences, making informed decision-making paramount. This resource Read More …

How Often Are Student Loans Compounded?

Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the often-misunderstood concept of compound interest. Understanding how frequently your loan accrues interest—daily, monthly, or annually—significantly impacts the total amount you’ll ultimately repay. This exploration delves into the mechanics of compound interest applied to student loans, examining how different compounding frequencies affect your overall debt burden and offering strategies for minimizing their impact. This guide will demystify the process, providing clear examples and practical advice to help you make informed decisions about your student loan repayment. We’ll explore the factors influencing compounding frequency, compare different loan Read More …

Can You Use Student Loans for Credit Card Debt?

The crushing weight of credit card debt is a common struggle, leading many to explore unconventional solutions. One question frequently arises: can student loans be used to alleviate this burden? While seemingly a simple fix, using student loans to pay off credit cards involves complex financial considerations, potential pitfalls, and long-term implications that demand careful evaluation. This exploration delves into the intricacies of this approach, weighing the potential benefits against the significant risks. This guide examines various debt management strategies, including student loan consolidation and refinancing, highlighting their suitability (or lack thereof) for tackling credit card debt. We’ll also discuss Read More …

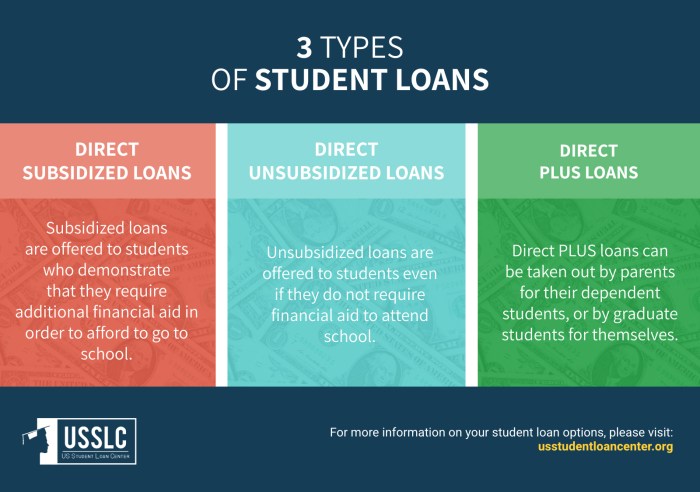

Can You Transfer Student Loans to Another Person?

Navigating the complexities of student loan debt can be daunting, and the question of transferring that debt to another individual often arises. This exploration delves into the intricacies of transferring both federal and private student loans, examining the legal, ethical, and practical considerations involved. We’ll explore the limited circumstances under which transfers might be permissible and highlight the potential pitfalls of attempting unauthorized transfers. Understanding the differences between loan transfers and loan assumptions is crucial. We will compare and contrast these options, detailing the requirements and implications of each. Furthermore, we’ll discuss alternative debt management strategies, such as refinancing, consolidation, Read More …

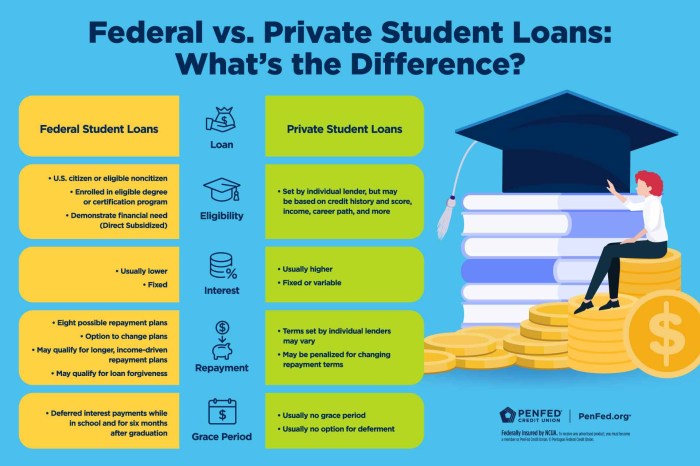

Best Rates for Private Student Loans

Securing the best rates for private student loans is crucial for navigating the complexities of higher education financing. Understanding the factors that influence interest rates, from credit scores to loan amounts and repayment terms, empowers students to make informed decisions. This guide explores strategies for obtaining favorable rates, including improving creditworthiness, exploring refinancing options, and effectively comparing loan offers from various lenders. We’ll also delve into hidden fees, responsible borrowing practices, and alternative funding sources to ensure a comprehensive understanding of the financial landscape. The journey to affordable higher education often begins with a thorough understanding of private student loan Read More …

How Interest Works on Student Loans

Navigating the complexities of student loan interest can feel overwhelming, but understanding how it works is crucial for responsible financial management. This guide demystifies the process, exploring various interest types, calculation methods, and strategies to minimize your overall cost. From fixed versus variable rates to the impact of repayment plans and loan forgiveness programs, we’ll equip you with the knowledge to make informed decisions about your student loan debt. We will delve into the intricacies of interest accrual, examining how daily interest is calculated and the significant influence of your chosen repayment plan. Furthermore, we’ll discuss effective strategies to reduce Read More …

Does Interest Compound on Student Loans?

Navigating the complexities of student loan repayment can feel like deciphering a financial code. A crucial element often overlooked is the impact of compound interest. Understanding how interest accrues and compounds on your student loans is vital for effective financial planning and minimizing long-term debt. This exploration delves into the mechanics of compound interest as it applies to student loans, offering insights into different loan types, repayment strategies, and the overall effect on your total loan cost. This guide will clarify the nuances of compound interest on various student loan programs, providing practical examples and strategies to help you manage Read More …

Credit Unions That Offer Student Loans

Navigating the world of student loans can feel overwhelming, but exploring credit unions as a funding source offers a refreshing alternative to traditional banks. Credit unions, known for their member-centric approach and often lower interest rates, provide a viable path to financing higher education. This guide delves into the advantages, processes, and considerations involved in securing student loans through credit unions, empowering you to make informed decisions about your financial future. From understanding eligibility requirements and comparing loan terms to navigating the application process and exploring loan consolidation options, we’ll cover the essential aspects of obtaining student loans from credit Read More …

Best Method to Pay Off Student Loans

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available strategies can significantly impact your financial future. This guide explores various approaches, from budgeting and repayment plan options to debt consolidation and refinancing, empowering you to develop a personalized plan for efficient and timely debt elimination. We’ll delve into the specifics of federal and private loans, interest rates, and repayment schedules. You’ll learn how to create a realistic budget, identify areas for savings, and explore the advantages and disadvantages of different repayment strategies. Ultimately, the goal is to equip you with the knowledge and tools to Read More …