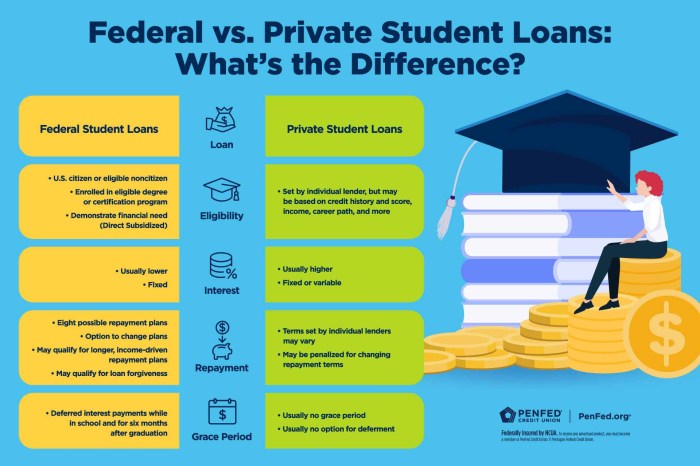

Navigating the complexities of student loan repayment can feel overwhelming. Understanding when your repayment journey begins is crucial for effective financial planning. This guide unravels the intricacies of grace periods, deferment options, repayment plans, and the factors influencing your repayment start date, empowering you to take control of your student loan debt. From the moment you graduate or leave school, the clock starts ticking on your repayment responsibilities. However, several factors can impact precisely when those payments are due, including the type of loan you have (federal or private), your enrollment status, and the repayment plan you choose. This guide Read More …