Navigating the complexities of student loan debt while simultaneously planning for retirement can feel overwhelming. Many grapple with the question: should I tap into my 401(k) to alleviate student loan burdens? This guide explores the financial, legal, and emotional implications of using 401(k) funds for student loan repayment, presenting a balanced perspective to help you make informed decisions. We’ll delve into the potential tax penalties and long-term retirement consequences of early 401(k) withdrawals. We’ll also examine viable alternatives, such as income-driven repayment plans and refinancing options, providing a comprehensive overview of your choices. Ultimately, the goal is to empower you Read More …

Tag: retirement planning

401k Student Loan Match Smart Retirement Strategies

Balancing student loan repayments with retirement savings can feel daunting, especially for young professionals. The seemingly insurmountable task of tackling both simultaneously often leads to delayed retirement planning, potentially impacting long-term financial security. However, understanding how employer-sponsored 401(k) plans, particularly those with matching contributions, can work in tandem with student loan repayment strategies can significantly alleviate this pressure and pave the way for a more financially stable future. This exploration delves into practical strategies and resources to help navigate this common financial challenge. This guide will unpack the mechanics of 401(k) plans, employer matching contributions, and effective budgeting techniques to Read More …

Payoff Student Loans or Invest?

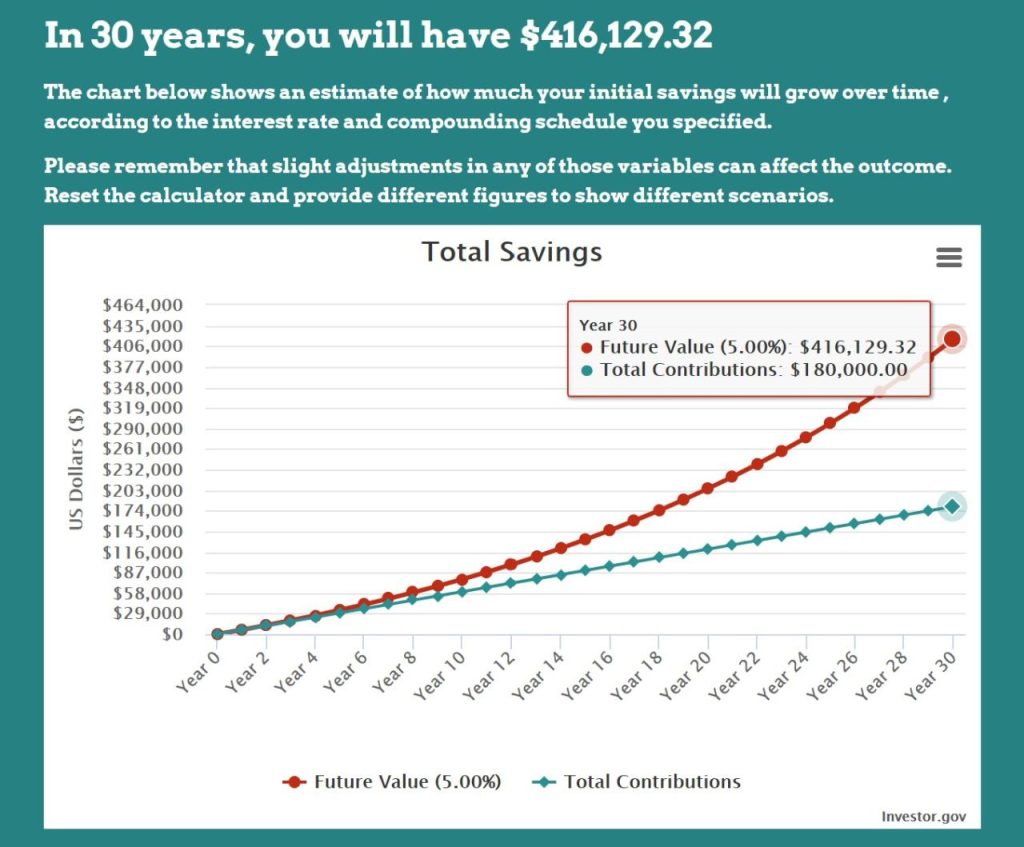

The age-old question for many graduates: tackle student loan debt aggressively or prioritize investing for future growth? This decision significantly impacts long-term financial well-being, requiring a careful assessment of individual circumstances, financial goals, and risk tolerance. Understanding the nuances of loan repayment strategies, investment options, and tax implications is crucial for making an informed choice that aligns with your aspirations. This guide provides a framework for evaluating both paths, considering factors like interest rates, loan types, potential investment returns, and the impact on your net worth over time. We’ll explore various investment vehicles, discuss the importance of an emergency fund, Read More …

Pay Off Student Loans With 401k A Financial Analysis

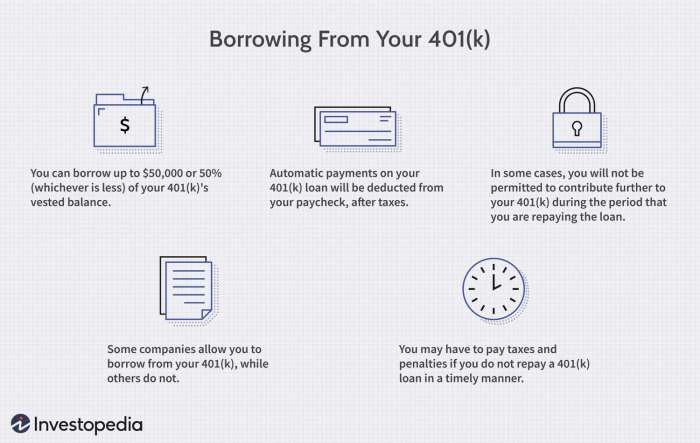

The crushing weight of student loan debt often clashes with the long-term goals of retirement savings. Many find themselves grappling with the tempting, yet potentially risky, proposition of using their 401(k) funds to pay off student loans. This exploration delves into the complexities of this decision, weighing the immediate benefits of debt elimination against the potential long-term consequences for retirement security. We will analyze the financial implications, explore alternative strategies, and provide a framework for making an informed decision. Understanding the tax implications, penalties, and long-term financial impact is crucial before considering such a significant move. This analysis will provide Read More …

401k Matching Student Loans & Retirement Planning

Balancing student loan repayment with maximizing 401(k) contributions is a significant financial challenge for many young professionals. The allure of immediate debt reduction often competes with the long-term benefits of employer-matched retirement savings. This exploration delves into effective strategies for navigating this crucial decision, examining the interplay between these two essential financial goals. We’ll analyze the potential long-term financial implications of prioritizing one over the other, exploring various budgeting techniques and financial planning approaches that allow individuals to successfully manage both student loan debt and retirement savings simultaneously. We’ll also examine employer-sponsored programs designed to assist employees in achieving both Read More …

Can You Use 401k to Pay Off Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often overshadowing other crucial financial goals. Many find themselves exploring unconventional avenues for relief, and one question frequently arises: can tapping into retirement savings, specifically a 401(k), offer a viable solution? This guide delves into the complexities of using your 401(k) to pay off student loans, weighing the potential benefits against the significant long-term financial ramifications. We’ll examine the intricate regulations surrounding early 401(k) withdrawals, the tax implications, and the various student loan repayment options available. Through detailed examples and comparisons, we aim to equip you with the Read More …

Can You Use Your 401k to Pay Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for many, leading some to explore unconventional solutions. One question frequently arises: can tapping into retirement savings, specifically a 401(k), alleviate this financial burden? This guide delves into the complexities of using your 401(k) to pay off student loans, weighing the potential short-term benefits against the significant long-term consequences for your retirement security. We’ll examine the intricate tax implications and penalties associated with early 401(k) withdrawals, contrasting them with alternative financing strategies such as refinancing and income-driven repayment plans. By understanding the potential financial ramifications, you can make an informed Read More …

Can You Use 401k to Pay Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often forcing difficult financial choices. One question frequently arises: can tapping into retirement savings, specifically a 401(k), provide a solution? While seemingly appealing, this decision carries significant financial implications, demanding a careful consideration of both short-term relief and long-term retirement security. This guide explores the complexities of using 401(k) funds to pay student loans, examining the regulations, alternatives, and potential consequences to help you make an informed decision. Understanding the rules surrounding 401(k) withdrawals is paramount. Early withdrawals typically incur penalties and taxes, significantly reducing the amount you Read More …

Can You Use a 401k to Pay Off Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often overshadowing other crucial financial goals. Many find themselves grappling with the question: can tapping into their 401(k) for student loan repayment offer a viable solution? This guide explores the complexities of this decision, weighing the potential benefits against the significant financial implications, and ultimately helping you make an informed choice. We’ll delve into the intricacies of 401(k) withdrawal regulations, including tax implications and penalties for early withdrawals. We’ll also examine alternative student loan repayment strategies and compare the potential returns of your 401(k) investments against the interest Read More …

Student Loan Retirement Match A Comprehensive Guide

Navigating the complexities of student loan debt and retirement planning simultaneously can feel daunting. However, a growing number of employers are recognizing this challenge and offering innovative solutions: student loan retirement match programs. These programs, which mirror traditional 401(k) matching contributions, provide a significant financial boost to employees struggling with student loan repayment, ultimately accelerating their path toward financial security. This guide delves into the mechanics of student loan retirement match programs, exploring their benefits for both employees and employers. We’ll examine program structures, tax implications, cost-benefit analyses, and effective communication strategies. By understanding the potential impact and addressing potential Read More …