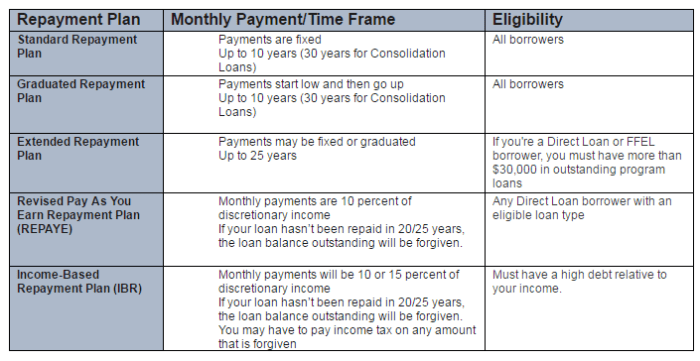

Navigating the complex world of student loan repayment can feel overwhelming. Fortunately, numerous “save” programs exist, designed to alleviate the financial burden and pave the way for a brighter future. Understanding these programs—their eligibility criteria, benefits, and potential drawbacks—is crucial for making informed decisions about your financial well-being. This guide provides a comprehensive overview of the application process, financial implications, and strategies for successfully securing student loan relief. From understanding different program types and eligibility requirements to mastering the application process and managing post-application procedures, this resource equips you with the knowledge and tools needed to successfully navigate the student Read More …