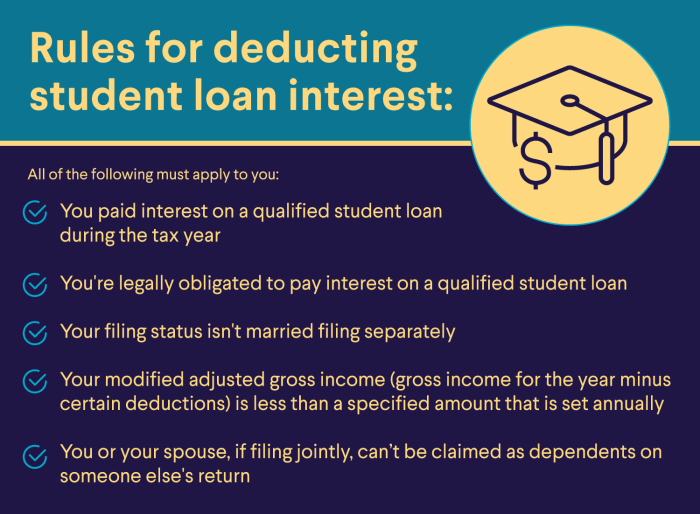

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering potential tax benefits. Understanding the maximum student loan interest deduction is crucial for borrowers seeking to minimize their tax burden. This guide provides a clear and concise overview of eligibility requirements, calculation methods, and strategies for maximizing this valuable deduction. We’ll explore how recent tax reforms have impacted the deduction and compare it to other student loan assistance programs, empowering you to make informed financial decisions. This exploration delves into the intricacies of the maximum student loan deduction, covering everything from determining eligibility based on your Modified Read More …

Tag: student loan deduction

Student Loan Maximum Deduction Explained

Navigating the complexities of student loan repayment is a significant challenge for many. Understanding the student loan interest deduction, and specifically the maximum allowable deduction, can significantly impact your tax burden and overall financial well-being. This guide provides a clear and concise explanation of the deduction, covering eligibility criteria, influencing factors, and potential pitfalls to help you maximize your savings. This exploration delves into the intricacies of the student loan interest deduction, examining how adjusted gross income (AGI), filing status, and other variables affect the maximum deductible amount. We’ll compare this deduction to other education-related tax benefits, providing a comprehensive Read More …

Student Loan Interest Deductibility Explained

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering potential tax benefits. Understanding the student loan interest deduction is crucial for borrowers seeking to minimize their tax burden. This guide offers a comprehensive overview of eligibility requirements, calculation methods, and relevant tax forms, empowering you to confidently claim this valuable deduction. We’ll delve into the intricacies of adjusted gross income (AGI) limitations, explore which loan types qualify, and provide clear examples to illustrate the deduction calculation process. Furthermore, we’ll compare the student loan interest deduction to other repayment assistance programs, helping you make informed decisions about Read More …

Maximize Your Tax Return: A Guide to the 2024 Student Loan Interest Deduction

Navigating the complexities of student loan repayment is a significant challenge for many. However, did you know that the IRS offers a potential tax break to ease the burden? The 2024 student loan interest deduction provides a valuable opportunity to reduce your tax liability, but understanding the eligibility requirements and calculation methods is crucial to maximizing its benefits. This guide will walk you through the process, ensuring you’re well-equipped to claim this deduction. This comprehensive guide will delve into the intricacies of the 2024 student loan interest deduction, covering eligibility criteria, calculation procedures, necessary documentation, and potential pitfalls to avoid. Read More …

Max Student Loan Deduction A Comprehensive Guide

Navigating the complexities of student loan repayment can be daunting, especially when considering potential tax benefits. Understanding the maximum student loan interest deduction is crucial for borrowers seeking to minimize their tax liability. This guide provides a clear and concise overview of eligibility requirements, calculation methods, and relevant tax forms, empowering you to maximize this valuable deduction. This in-depth exploration delves into the intricacies of the student loan interest deduction, comparing it to other education-related tax benefits and illustrating its potential impact on your overall tax burden. We’ll cover recent updates, potential future changes, and offer practical examples to help Read More …

Navigating the Student Loan Interest Deduction Limitation: A Comprehensive Guide

The student loan interest deduction, a seemingly straightforward tax break, reveals a complex landscape of limitations and eligibility requirements. Understanding these nuances is crucial for borrowers seeking to minimize their tax burden and effectively manage their student loan debt. This guide delves into the history, current limitations, and potential future of this vital deduction, providing clarity and insight for both current and prospective borrowers. From its inception, the student loan interest deduction has aimed to ease the financial strain of higher education. However, the ever-evolving landscape of federal tax policy has introduced significant changes, including income limitations and restrictions on Read More …

Maximizing Your Tax Return: A Guide to Student Loan Deduction Taxes

Navigating the complexities of student loan repayment is a significant challenge for many, but understanding the potential tax benefits can alleviate some of the financial burden. The student loan interest deduction offers a valuable opportunity to reduce your tax liability, but claiming it correctly requires careful consideration of eligibility requirements and calculation methods. This guide provides a comprehensive overview of the student loan interest deduction, empowering you to make informed decisions about your taxes and student loan repayment strategy. This guide will walk you through the intricacies of the student loan interest deduction, covering eligibility criteria, calculation procedures, and potential Read More …