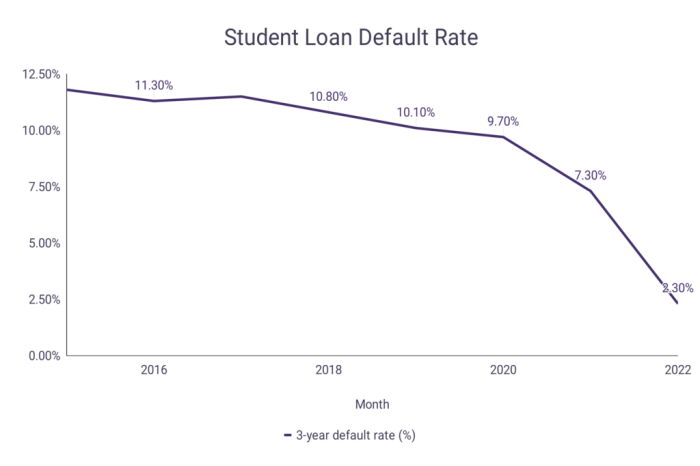

Student loan default is a serious financial predicament, impacting credit scores, future borrowing capabilities, and even leading to wage garnishment. Navigating the complexities of escaping default can feel overwhelming, but understanding the available options is the first step towards regaining financial stability. This guide provides a clear pathway through the process, exploring various rehabilitation, consolidation, and repayment strategies to help you reclaim control of your student loan debt. From understanding the precise definition of default and its consequences to exploring legal considerations and preventative measures, we aim to equip you with the knowledge and resources to effectively manage your situation. Read More …