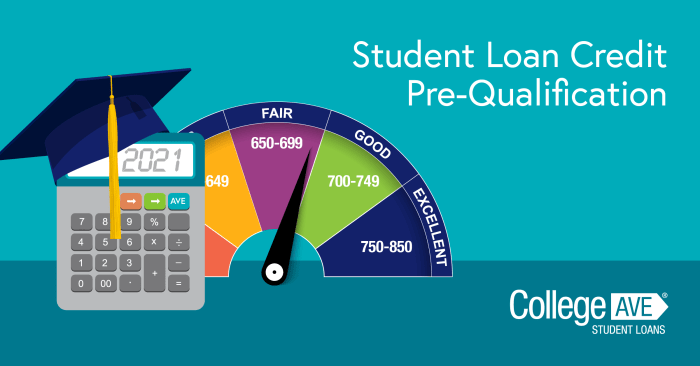

Navigating the complexities of higher education often involves securing student loans. For many students, this journey necessitates a cosigner – a financially responsible individual willing to share the burden of repayment. However, understanding the requirements for cosigning a student loan is crucial, as it involves significant financial responsibilities for both the student and the cosigner. This guide delves into the essential aspects of cosigning, offering clarity on eligibility, responsibilities, and potential implications. From assessing your eligibility based on credit history and income to understanding the potential risks involved in shouldering another’s debt, this comprehensive overview will equip you with the Read More …