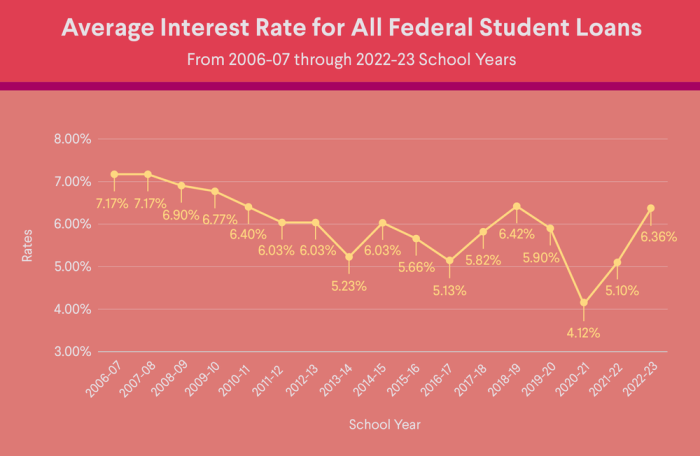

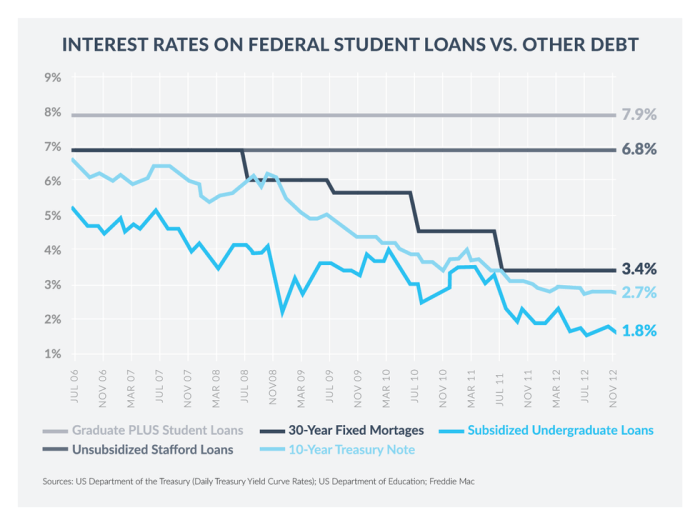

Navigating the complexities of student loan interest rates can feel overwhelming. What constitutes a “high” interest rate is subjective, influenced by factors like prevailing economic conditions and individual financial circumstances. This guide provides a clear understanding of student loan interest rates, helping you assess whether your rate is high and what steps you can take to manage your debt effectively. We’ll explore various loan types, the factors influencing interest rates (including credit score, loan term, and economic climate), and practical strategies for managing high-interest loans. Understanding these elements empowers you to make informed decisions about your student loan debt and Read More …