Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with multiple private loans. Student loan consolidation for private loans offers a potential solution, allowing borrowers to combine several loans into a single, more manageable payment. This process can simplify repayment, potentially lower monthly payments, and offer a clearer path to becoming debt-free. However, it’s crucial to understand the nuances before making a decision, as consolidation isn’t always the best approach for everyone. This guide explores the benefits, drawbacks, and crucial considerations involved in consolidating private student loans. We’ll delve into the mechanics of private loan consolidation, Read More …

Tag: Student Loan Management

When Are My Student Loans Due? A Comprehensive Guide to Repayment Schedules

Navigating the complexities of student loan repayment can feel like deciphering a cryptic code. Understanding when your payments are due is crucial to avoiding late fees and maintaining a healthy credit score. This guide provides a clear and concise overview of student loan repayment schedules, highlighting key factors influencing due dates and offering practical strategies for effective payment management. From understanding different repayment plans and grace periods to mastering online account access and budgeting techniques, we’ll equip you with the knowledge and tools to confidently manage your student loan debt. We’ll explore the consequences of late payments, the benefits of Read More …

Nelnet Pay Student Loans A Comprehensive Guide

Navigating student loan repayment can feel overwhelming, but understanding your options is key to financial success. This guide delves into the world of Nelnet student loan payments, providing a clear and concise overview of payment methods, managing your account, and troubleshooting potential issues. We’ll explore the various ways to pay, from online portals to traditional mail, and discuss strategies for effective budgeting and avoiding late payments. Whether you’re a recent graduate or have been managing your loans for years, this resource aims to equip you with the knowledge to confidently handle your Nelnet student loan payments. We will cover Nelnet’s Read More …

Launch Servicing Student Loans A Comprehensive Guide

The launch of a new student loan servicing system is a complex undertaking, impacting numerous stakeholders from borrowers and universities to government agencies and technology providers. Success hinges on meticulous planning, seamless execution, and effective communication. This guide delves into the multifaceted process, exploring the challenges, opportunities, and future trends shaping this critical area of higher education finance. From understanding the nuances of “launch” in this context to navigating the technological and regulatory complexities, we’ll examine each step involved in creating and deploying a robust and user-friendly student loan servicing platform. We will also explore the crucial role of effective Read More …

Navigating the Maze: A Comprehensive Guide to Student Loan Payments

The weight of student loan debt is a significant reality for millions, impacting financial decisions and shaping long-term prospects. Understanding the intricacies of student loan payments—from repayment plans and interest accrual to forgiveness programs and debt management strategies—is crucial for navigating this complex financial landscape successfully. This guide provides a clear and concise overview, empowering you to make informed choices and achieve financial well-being. From the initial disbursement of funds to the final payment, the journey of student loan repayment involves several key steps, options, and potential pitfalls. This comprehensive resource delves into the various repayment plans, explores the impact Read More …

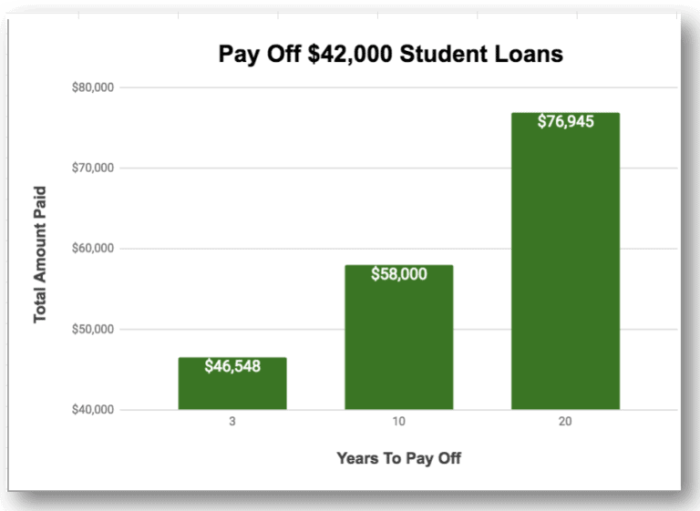

Is 40k in Student Loans a Lot?

Navigating the complexities of student loan debt can feel overwhelming, especially when considering a figure like $40,000. Is this amount significant? The answer isn’t straightforward, as it hinges on numerous personal factors. This exploration delves into the nuances of this question, considering individual income potential, career paths, and the ever-present cost of living. We’ll examine the long-term implications of such debt on major life milestones, from homeownership and family planning to retirement savings. By comparing this figure to national averages and exploring various repayment strategies, we aim to provide a comprehensive understanding of whether $40,000 in student loans constitutes a Read More …

How to Switch Student Loan Servicers

Navigating the complexities of student loan repayment can feel overwhelming, especially when dealing with a less-than-ideal servicer. Understanding your options and the process of switching servicers empowers you to take control of your financial future. This guide provides a clear and concise path to a smoother, more manageable loan repayment journey, addressing common concerns and offering practical solutions. This comprehensive guide will walk you through each step, from identifying your current servicer and understanding your reasons for switching to selecting a new provider and managing the transition. We’ll cover potential pitfalls and how to avoid them, ensuring a seamless transfer Read More …

How to Check on Student Loans

Navigating the world of student loans can feel overwhelming, especially when trying to keep track of balances, payments, and repayment plans. Understanding how to access and interpret your loan information is crucial for responsible financial management and avoiding potential pitfalls. This guide provides a comprehensive overview of how to effectively check your student loan status, ensuring you’re always informed and in control of your financial future. From identifying your loan servicer to utilizing online portals and mobile apps, we’ll walk you through each step of the process. We’ll also cover crucial topics like understanding your loan statements, exploring repayment options, Read More …

Citizens Bank Student Loan Sign In

Managing your Citizens Bank student loan effectively requires understanding the online portal. This guide provides a comprehensive overview of the sign-in process, account navigation, loan management tools, and crucial contact information for support. We’ll explore everything from accessing your account and making payments to understanding deferment options and maintaining online security. From initial login to advanced features like managing multiple loans and utilizing deferment options, this guide aims to equip you with the knowledge to confidently handle your student loan responsibilities. We’ll break down the steps involved, explain key features, and provide helpful tips to streamline the process. Understanding the Read More …

How to Remove a Cosigner From Student Loan

Navigating the complexities of student loan cosigners can feel overwhelming. Securing a loan with a cosigner often opens doors to better interest rates and approval, but maintaining that relationship requires understanding mutual responsibilities. This guide explores the process of removing a cosigner from your student loan, outlining eligibility criteria, necessary steps, and alternative solutions should removal prove challenging. Successfully removing a cosigner hinges on demonstrating financial responsibility and creditworthiness. This involves consistent on-time payments, building a strong credit history, and maintaining a healthy debt-to-income ratio. Understanding the lender’s requirements and proactively addressing any potential roadblocks is crucial for a smooth Read More …