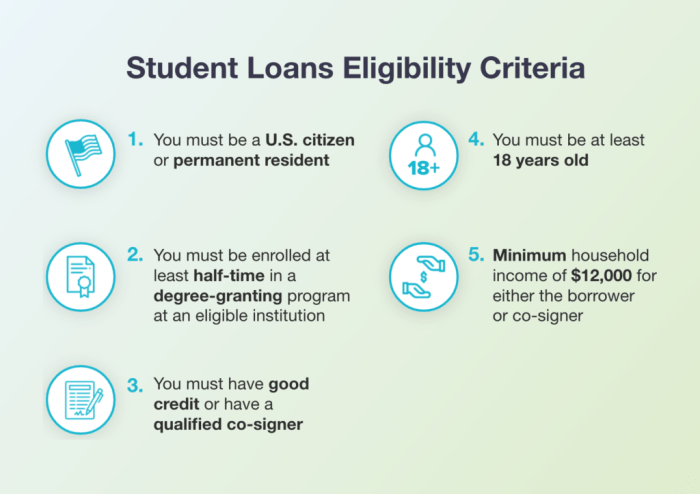

Navigating the complexities of student loan refinancing can feel overwhelming. This guide focuses specifically on First Republic Bank’s offerings, providing a clear and concise overview of their refinancing programs. We’ll explore eligibility requirements, interest rates, fees, and compare their services to other major lenders. Understanding the nuances of loan terms and the impact of credit scores is crucial to making an informed decision. From understanding the application process to analyzing potential cost savings and risks, this resource aims to empower you with the knowledge necessary to confidently approach student loan refinancing with First Republic Bank. Understanding First Republic Bank’s Role Read More …